A) rises, because one unit of currency buys more ice cream cones.

B) rises, because one unit of currency buys fewer ice cream cones.

C) falls, because one unit of currency buys more ice cream cones.

D) falls, because one unit of currency buys fewer ice cream cones.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When we assume that the supply of money is a variable that the central bank controls, we

A) must then assume as well that the demand for money is not influenced by the value of money.

B) must then assume as well that the price level is unrelated to the value of money.

C) are ignoring the fact that, in the real world, households are also suppliers of money.

D) are ignoring the complications introduced by the role of the banking system.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The nominal interest rate is 4%, the inflation rate is 1% and the tax rate is 20%. Given U.S. tax laws, how is after- tax real return computed?

A) .03(1-.20)

B) .04(1 -.20)

C) .04(1 - .20) - .01

D) None of the above is correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You put money into an account and earn a real interest rate of 6 percent. Inflation is 3 percent, and your marginal tax rate is 20 percent. What is your after-tax real rate of interest?

A) 4.8 percent

B) 5.4 percent

C) 7.2 percent

D) 4.2 percent.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) Inflation impedes financial markets in their role of allocating savings to alternative investments.

B) Inflation encourages savings through the tax treatment on capital gains.

C) Inflation encourages larger holdings of currency by the public.

D) Inflation reduces people's real purchasing power.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The idea that inflation by itself reduces people's purchasing power is called

A) the inflation tax.

B) menu costs.

C) the inflation fallacy.

D) shoeleather costs.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inflation can be measured by the

A) change in the consumer price index. Inflation in the U.S. has averaged about 2.5% over the last 80 years.

B) change in the consumer price index. Inflation in the U.S. has averaged about 4% over the last 80 years.

C) percentage change in the consumer price index. Inflation in the U.S. has averaged about 3.6% over the last 80 years.

D) percentage change in the consumer price index. Inflation in the U.S. has averaged about 4% over the last 80 years.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that M is fixed but that P falls. According to the quantity equation which of the following could both by themselves explain the decrease in P?

A) Y rose, V rose

B) Y fell, V fell

C) Y rose, V fell

D) Y fell, V rose

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

The nominal interest rate is eight percent and the consumer price index rises from 140 to 147. What is the real interest rate?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When inflation falls, people

A) make less frequent trips to the bank and firms make less frequent price changes.

B) make less frequent trips to the bank while firms make more frequent price changes.

C) make more frequent trips to the bank while firms make less frequent price changes.

D) make more frequent trips to the bank and firms make more frequent price changes.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You bought some shares of stock and sell them one year later. At the end of the year, the price per share was 5 percent higher and the price level was 3 percent higher. Before taxes, you experienced

A) both a nominal gain and a real gain, and you paid taxes on the nominal gain.

B) both a nominal gain and a real gain, and you paid taxes only on the real gain.

C) a nominal gain and a real loss, and you paid taxes on the nominal gain.

D) a nominal gain and a real loss, and you paid no taxes on the transaction.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Consumer Price Index increases from 100 to 120

A) more money is needed to buy the same amount of goods, so the value of money falls.

B) more money is needed to buy the same amount of goods, so the value of money rises.

C) less money is needed to buy the same amount of goods, so the value of money falls.

D) less money is needed to buy the same amount of goods, so the value of money rises.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

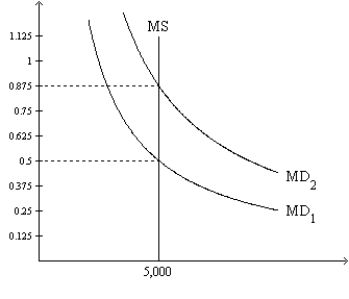

Figure 30-2. On the graph, MS represents the money supply and MD represents money demand. The usual quantities are measured along the axes.  -Refer to Figure 30-2. If the relevant money-demand curve is the one labeled MD1, then the equilibrium value of money is

-Refer to Figure 30-2. If the relevant money-demand curve is the one labeled MD1, then the equilibrium value of money is

A) 0.5 and the equilibrium price level is 2.

B) 2 and the equilibrium price level is 0.5.

C) 0.5 and the equilibrium price level cannot be determined from the graph.

D) 2 and the equilibrium price level cannot be determined from the graph.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that monetary neutrality and the Fisher effect both hold. An increase in the money supply growth rate increases

A) the inflation rate and nominal interest rates.

B) the inflation rate, but not nominal interest rates.

C) nominal interest rates, but not the inflation rate.

D) neither the inflation rate nor nominal interest rates.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over time both real GDP and the price level have trended upward. Which of these trends would the classical dichotomy say could be explained by an upward trend in the money supply?

A) both the upward trend in real GDP and the upward trend in the price level

B) the upward trend in real GDP but not the upward trend in the price level

C) the upward trend in the price level but not the upward trend in real GDP

D) neither the upward trend in the price level nor the upward trend in real GDP

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The source of hyperinflations is primarily

A) lower output growth.

B) continuing declines in velocity.

C) increases in money-supply growth.

D) continuing increases in money demand.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If inflation is higher than what was expected,

A) creditors receive a lower real interest rate than they had anticipated.

B) creditors pay a lower real interest rate than they had anticipated.

C) debtors receive a higher real interest rate than they had anticipated.

D) debtors pay a higher real interest rate than they had anticipated.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the nominal interest rate is 5 percent and there is a deflation rate of 3 percent, what is the real interest rate?

A) 8 percent

B) 2 percent

C) 15 percent

D) 1.7 percent

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose there is a surplus in the money market.

A) This could have been created by an increase in the money supply. The value of money will rise.

B) This could have been created by an increase in the money supply. The value of money will fall.

C) This could have been created by a decrease in the money supply. The value of money will rise.

D) This could have been created by a decrease in the money supply. The value of money will fall.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the U.S., taxes on capital gains are computed using

A) nominal gains. This is one way by which higher inflation discourages saving.

B) nominal gains. This is one way by which higher inflation encourages saving.

C) real gains. This is one way by which higher inflation discourages saving.

D) real gains. This is one way by which higher inflation encourages saving.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 481

Related Exams