A) three times the cost of providing subsidized housing.

B) three times the cost of providing an adequate diet.

C) the minimum wage for a single person working 40 hours per week and 50 weeks per year.

D) the cost of providing food, shelter, and health care expenses for a family of four.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For which of the following programs can a person qualify solely by having a low income?

A) both Temporary Assistance for Needy Families (TANF) and Supplemental Security Income (SSI)

B) Temporary Assistance for Needy Families (TANF) but not Supplemental Security Income (SSI)

C) Supplemental Security Income (SSI) but not Temporary Assistance for Needy Families (TANF)

D) neither Temporary Assistance for Needy Families (TANF) nor Supplemental Security Income (SSI)

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 20-4 Suppose the government implemented a negative income tax and used the following formula to compute a family's tax liability: Taxes owed = (1/5 of income) - $15,000 -Refer to Scenario 20-4. A family earning $50,000 before taxes would have how much after-tax income?

A) -$5,000

B) $40,000

C) $45,000

D) $55,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which group would be the least upset by wide variation in the income distribution?

A) utilitarians

B) liberals

C) libertarians

D) Each group would be equally upset.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

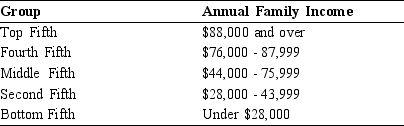

Table 20-3

The Distribution of Income in Edgerton  -Refer to Table 20-3. Where would the government in Edgerton set the poverty line to have a poverty rate of 40 percent?

-Refer to Table 20-3. Where would the government in Edgerton set the poverty line to have a poverty rate of 40 percent?

A) $28,000

B) $44,000

C) $76,000

D) $88,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A society consists of three individuals: Sam, Tristan, and Ulyana. In terms of income and utility, Sam is currently best-off, Tristan ranks in the middle, and Ulyana is worst-off. Which of the following statements is correct?

A) Utilitarianism suggests that government policies should strive to maximize Ulyana's utility.

B) Liberalism suggests that government policies should strive to increase Ulyana's utility.

C) Libertarianism suggests that government policies should strive to improve Tristan's utility at the cost of Sam's utility.

D) Libertarianism suggests that government policies should strive to make Sam, Tristan, and Ulyana equally well off.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The political philosophy that views the redistribution of income as a form of social insurance is

A) utilitarianism

B) liberalism

C) libertarianism

D) welfarism

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that young people often borrow and then repay the loans when they are older. These actions relate to which problem in measuring inequality?

A) in-kind transfers

B) the economic life cycle

C) a negative income tax

D) economic mobility

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The rule for redistribution proposed by John Rawls in his book A Theory of Justice is called the

A) "optimal ignorance" rule.

B) libertarian justice rule.

C) maximin criterion.

D) egalitarian criterion.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The best government policy to reduce poverty is

A) a minimum wage law because the resulting unemployment is small in comparison to the benefits to people it helps.

B) an expanded welfare program because people must have an additional "need" such as small children or a disability.

C) an in-kind transfer because it ensures that the poor receive what they need most such as food or shelter.

D) not obvious. Government programs to reduce poverty have many advantages but also many disadvantages.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The life cycle effect characterizes a lifetime income profile in which income

A) tends to follow a seasonal pattern.

B) rises as a worker gains maturity and experience.

C) rises and falls in conjunction with the business cycle.

D) falls during the early years of market activity and peaks at retirement.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that a family saves and borrows to buffer itself against changes in income. These actions relate to which problem in measuring inequality?

A) in-kind transfers

B) negative income tax

C) transitory versus permanent income

D) economic mobility

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

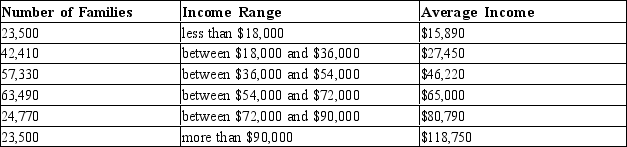

Table 20-13

Distribution of Income in Imagination  -Refer to Table 20-13. If the poverty rate in Imagination is 10%, what is the poverty line?

-Refer to Table 20-13. If the poverty rate in Imagination is 10%, what is the poverty line?

Correct Answer

verified

Correct Answer

verified

True/False

Critics argue that a disadvantage of minimum-wage laws is that they do not effectively target the working poor because many minimum-wage workers are the teenage children of middle-income families.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The United States has greater income

A) disparity than most other economically advanced countries, but a more equal income distribution than some developing countries.

B) disparity than both other economically advanced and all developing countries.

C) equality than most other economically advanced countries but greater income disparity than some developing countries.

D) equality than both other economically advanced and developing countries.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

Goods and services given to the poor such as food stamps, housing vouchers, and medical services are called

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The utilitarian case for redistributing income is based on the assumption of

A) collective consensus.

B) a notion of fairness engendered by equality.

C) diminishing marginal utility.

D) rising marginal utility.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) A disadvantage of a minimum-wage law is that it may benefit unskilled workers who are not low-income workers.

B) A disadvantage of a negative income tax program is that a poor person who chooses not to work many hours would receive a cash benefit.

C) A disadvantage of an Earned Income Tax Credit (EITC) is that a person who is unable to work due to a disability does not benefit from the program.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The calculation of the poverty line includes adjustments for

A) energy costs.

B) child care costs.

C) the level of prices.

D) the Earned Income Tax Credit.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) Governments can never improve market outcomes.

B) Governments can sometimes improve market outcomes.

C) Governments can always improve market outcomes.

D) Government can never make the income distribution more equal.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 455

Related Exams