A) purchase government bonds, which will increase the money supply.

B) purchase government bonds, which will reduce the money supply.

C) sell government bonds, which will increase the money supply.

D) sell government bonds, which will reduce the money supply.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

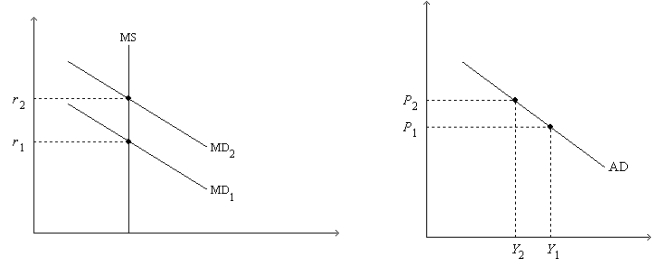

Figure 34-2. On the left-hand graph, MS represents the supply of money and MD represents the demand for money; on the right-hand graph, AD represents aggregate demand. The usual quantities are measured along the axes of both graphs.

-Refer to Figure 34-2. If the money-supply curve MS on the left-hand graph were to shift to the left, this would

-Refer to Figure 34-2. If the money-supply curve MS on the left-hand graph were to shift to the left, this would

A) represent an action taken by the Federal Reserve.

B) shift the AD curve to the left.

C) create, until the interest rate adjusted, an excess demand for money at the interest rate that equilibrated the money market before the shift.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a certain economy, when income is $100, consumer spending is $60. The value of the multiplier for this economy is 4. It follows that, when income is $101, consumer spending is

A) $60.25.

B) $60.75.

C) $61.33.

D) $64.00.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The multiplier for changes in government spending is calculated as

A) 1/1+MPC) .

B) 1 - MPC) /MPC.

C) 1/MPC.

D) 1/1 - MPC) .

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In recent years, the Fed has chosen to target interest rates rather than the money supply because

A) Congress passed a law requiring them to do so.

B) the President requested them to do so.

C) the money supply is hard to measure with sufficient precision.

D) changes in the interest rate change aggregate demand, but changes in the money supply do not.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An essential piece of the liquidity preference theory is the demand for money.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the short run, an increase in the money supply causes interest rates to

A) increase, and aggregate demand to shift right.

B) increase, and aggregate demand to shift left.

C) decrease, and aggregate demand to shift right.

D) decrease, and aggregate demand to shift left.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to liquidity preference theory, an increase in the price level shifts the

A) money demand curve rightward, so the interest rate increases.

B) money demand curve rightward, so the interest rate decreases.

C) money demand curve leftward, so the interest rate decreases.

D) money demand curve leftward, so the interest rate increases.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

During recessions, the government tends to run a budget deficit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most economists believe that fiscal policy

A) only affects aggregate demand and not aggregate supply.

B) primarily affects aggregate demand.

C) primarily effects aggregate supply.

D) only affects aggregate supply and not aggregate demand.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 501 - 510 of 510

Related Exams