A) increases the multiplier, so that changes in government expenditures have a larger effect on aggregate demand.

B) increases the multiplier, so that changes in government expenditures have a smaller effect on aggregate demand.

C) decreases the multiplier, so that changes in government expenditures have a larger effect on aggregate demand.

D) decreases the multiplier, so that changes in government expenditures have a smaller effect on aggregate demand.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

An essential piece of the liquidity preference theory is the demand for money.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Initially, the economy is in long-run equilibrium. The aggregate demand curve then shifts $80 billion to the left. The government wants to change spending to offset this decrease in demand. The MPC is 0.75. Suppose the effect on aggregate demand of a tax change is 3/4 as strong as the effect of a change in government expenditure. There is no crowding out and no accelerator effect. What should the government do if it wants to offset the decrease in real GDP?

A) Raise both taxes and expenditures by $80 billion dollars.

B) Raise both taxes and expenditures by $10 billion dollars.

C) Reduce both taxes and expenditures by $80 billion dollars.

D) Reduce both taxes and expenditures by $10 billion dollars.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the government reduces taxes, which of the following decreases?

A) consumption

B) take-home pay

C) household saving

D) None of the above is correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to John Maynard Keynes,

A) the demand for money in a country is determined entirely by that nation's central bank.

B) the supply of money in a country is determined by the overall wealth of the citizens of that country.

C) the interest rate adjusts to balance the supply of, and demand for, money.

D) the interest rate adjusts to balance the supply of, and demand for, goods and services.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in government purchases is likely to

A) decrease interest rates.

B) result in a net decrease in aggregate demand.

C) crowd out investment spending by business firms.

D) decrease money demand.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Paul Samuelson, a famous economist, said that

A) "the bond market has predicted zero out of the past nine recessions."

B) "the stock market has predicted zero out of the past nine recessions."

C) "the bond market has predicted nine out of the past five recessions."

D) "the stock market has predicted nine out of the past five recessions."

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The main criticism of those who doubt the ability of the government to respond in a useful way to the business cycle is that the theory by which money and government expenditures change output is flawed.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the marginal propensity to consume is 5/6, and there is no investment accelerator or crowding out, a $20 billion increase in government expenditures would shift the aggregate demand curve right by

A) $60 billion, but the effect would be larger if there were an investment accelerator.

B) $60 billion, but the effect would be smaller if there were an investment accelerator.

C) $120 billion, but the effect would be larger if there were an investment accelerator.

D) $120 billion, but the effect would be smaller if there were an investment accelerator.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest rate falls if

A) the price level falls or the money supply falls.

B) the price level falls or the money supply rises.

C) the price level rises or the money supply falls.

D) the price level rises or the money supply rises.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

For the U.S. economy, the most important reason for the downward slope of the aggregate-demand curve is the interest-rate effect.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Opponents of active stabilization policy

A) advocate a monetary policy designed to offset changes in the unemployment rate.

B) argue that fiscal policy is unable to change aggregate demand or aggregate supply.

C) believe that the political process creates lags in the implementation of fiscal policy.

D) None of the above is correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When government expenditures increase, the interest rate

A) increases, making the change in aggregate demand larger.

B) increases, making the change in aggregate demand smaller

C) decreases, making the change in aggregate demand larger.

D) decreases, making the change in aggregate demand smaller.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to liquidity preference theory, the money-supply curve would shift if the Fed

A) engaged in open-market transactions.

B) changed the discount rate.

C) changed the reserve requirement.

D) did any of the above.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Liquidity preference theory is most relevant to the

A) short run and supposes that the price level adjusts to bring money supply and money demand into balance.

B) short run and supposes that the interest rate adjusts to bring money supply and money demand into balance.

C) long run and supposes that the price level adjusts to bring money supply and money demand into balance.

D) long run and supposes that the interest rate adjusts to bring money supply and money demand into balance.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

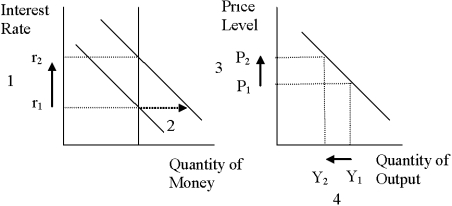

Figure 16-3.

-Refer to Figure 16-3. What quantity is represented by the vertical line on the left-hand graph?

-Refer to Figure 16-3. What quantity is represented by the vertical line on the left-hand graph?

A) the supply of money

B) the demand for money

C) the rate of inflation

D) the quantity of bonds that was most recently sold or purchased by the Federal Reserve

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

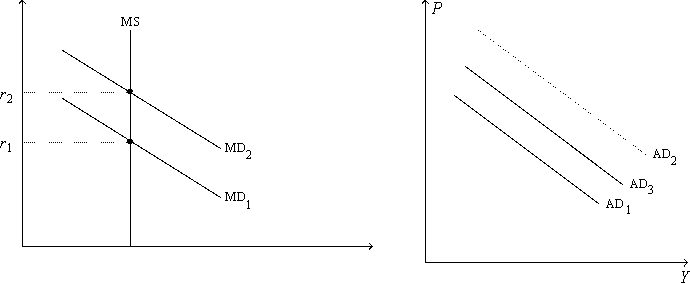

Figure 16-6. On the left-hand graph, MS represents the supply of money and MD represents the demand for money; on the right-hand graph, AD represents aggregate demand. The usual quantities are measured along the axes of both graphs.

-Refer to Figure 16-6. Suppose the multiplier is 3 and the government increases its purchases by $25 billion. Also, suppose the AD curve would shift from AD1 to AD2 if there were no crowding out; the AD curve actually shifts from AD1 to AD3 with crowding out. Finally, assume the horizontal distance between the curves AD1 and AD3 is $30 billion. The extent of crowding out, for any particular level of the price level, is

-Refer to Figure 16-6. Suppose the multiplier is 3 and the government increases its purchases by $25 billion. Also, suppose the AD curve would shift from AD1 to AD2 if there were no crowding out; the AD curve actually shifts from AD1 to AD3 with crowding out. Finally, assume the horizontal distance between the curves AD1 and AD3 is $30 billion. The extent of crowding out, for any particular level of the price level, is

A) $25 billion.

B) $30 billion.

C) $45 billion.

D) $60 billion.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A 2009 article in The Economist noted that some studies have provided evidence indicating that multipliers are

A) smaller in closed economies than in open economies.

B) larger in closed economies than in open economies.

C) smaller in capitalist economies than in socialist economies.

D) larger in capitalist economies than in socialist economies.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Federal Reserve increases the money supply, then initially people want to

A) sell bonds so the interest rate rises.

B) sell bonds so the interest rate falls.

C) buy bonds so the interest rate rises.

D) buy bonds so the interest rate falls.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to liquidity preference theory, if there were a shortage of money, then

A) the interest rate would be above equilibrium and the quantity of money demanded would be too large for equilibrium.

B) the interest rate would be above equilibrium and the quantity of money demanded would be too small for equilibrium.

C) the interest rate would be below equilibrium and the quantity of money demanded would be too small for equilibrium.

D) the interest rate would be below equilibrium and the quantity of money demanded would be too large for equilibrium.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 281 - 300 of 416

Related Exams