Filters

Question type

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 82

True/False

A tax on sellers and an increase in input prices affect the supply curve in the same way.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 83

True/False

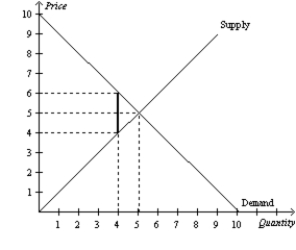

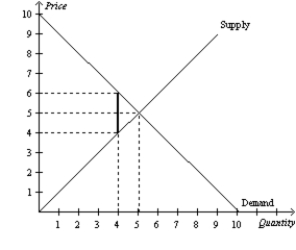

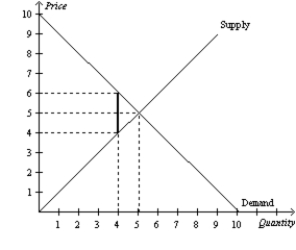

Figure 6-36  -Refer to Figure 6-36.If the government places a $2 tax in the market,the buyer pays $6.

-Refer to Figure 6-36.If the government places a $2 tax in the market,the buyer pays $6.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 84

True/False

The wedge between the buyers' price and the sellers' price is the same,regardless of whether the tax is levied on buyers or sellers.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 85

True/False

A tax on sellers shifts the supply curve but not the demand curve.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 86

True/False

A tax on buyers decreases demand.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 87

True/False

Figure 6-36  -Refer to Figure 6-36.If the government places a $2 tax in the market,the seller receives $4.

-Refer to Figure 6-36.If the government places a $2 tax in the market,the seller receives $4.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 88

True/False

A price ceiling is a legal minimum on the price at which a good or service can be sold.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 89

True/False

If a price floor is not binding,then it will have no effect on the market.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 90

True/False

Buyers and sellers always share the burden of a tax equally.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 91

True/False

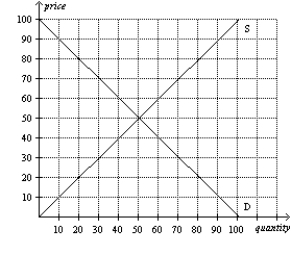

Figure 6-35  -Refer to Figure 6-35.A price ceiling set at $70 would create a shortage of 40 units.

-Refer to Figure 6-35.A price ceiling set at $70 would create a shortage of 40 units.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 92

True/False

When free markets ration goods with prices,it is both efficient and impersonal.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 93

True/False

Renters of rent-controlled apartments will likely benefit from both lower rents and higher quality of apartments.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 94

True/False

If the demand curve is very elastic and the supply curve is very inelastic in a market,then the sellers will bear a greater burden of a tax imposed on the market,even if the tax is imposed on the buyers.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 95

True/False

FICA is an example of a payroll tax,which is a tax on the wages that firms pay their workers.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 96

True/False

Long lines and gasoline shortages during the 1970's can be attributed completely to the decision by OPEC to raise crude oil prices.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 97

True/False

A tax on sellers usually causes buyers to pay more for the good and sellers to receive less for the good than they did before the tax was levied.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 98

True/False

When a tax is imposed on a good,the result is always a shortage of the good.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 99

True/False

Figure 6-36  -Refer to Figure 6-36.If the government places a $2 tax in the market,the buyer bears $1 of the tax burden.

-Refer to Figure 6-36.If the government places a $2 tax in the market,the buyer bears $1 of the tax burden.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 100

True/False

Policymakers use taxes to raise revenue for public purposes and to influence market outcomes.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 166

Related Exams