A) No, because Yvonne is a citizen of France.

B) No, because Yvonne was not present in the United States at least 183 days during the current year.

C) No, because although Yvonne was present in the United States at least 31 days during the current year, she was not present at least 183 days in a single year during the current or prior two years.

D) Yes, because Yvonne was present in the United States at least 31 days during the current year and 215 days during the current and prior two years (using the appropriate fractions for the prior years) .

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Without the foreign tax credit, double taxation would result when:

A) The United States taxes the U.S.-source income of a U.S. resident.

B) A foreign country taxes the foreign-source income of a nonresident alien.

C) The United States and a foreign country both tax the foreign-source income of a U.S. resident.

D) Terms of a tax treaty assign income taxing rights to the U.S.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following determinations requires knowing the amount of one's foreign-source gross income?

A) Itemized deductions.

B) Foreign tax credit.

C) Calculation of a U.S. person's total taxable income.

D) Calculation of a U.S. person's deductible interest expense.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A deferral of Federal corporate income taxes by a multinational taxpayer is possible by using:

A) A subsidiary corporation in another country.

B) A licensing arrangement for a customer using the seller's software.

C) Both a. and b.

D) Neither a. nor b.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The transfer of the assets of a U.S. corporation's foreign branch to a newly formed foreign corporation is always tax deferred under § 351.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

AirCo, a domestic corporation, purchases inventory for resale from unrelated distributors within the United States and resells this inventory to customers outside the United States, with title passing outside the United States. What is the sourcing of AirCo's inventory sales income?

A) 100% U.S. source.

B) 100% foreign source.

C) 50% U.S. source and 50% foreign source.

D) 50% foreign source and 50% sourced based on location of manufacturing assets.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

Match the definition with the correct term. Not all of the terms have a match. A definition can be used more than once. a. Foreign base company income b. Foreign personal holding company income c. Controlled foreign corporation d. U.S. shareholder e. Previously taxed income f. More than 10 percent g. More than 50 percent h. More than 80 percent -Portfolio income treated as Subpart F income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An advance pricing agreement (APA) is used between:

A) Two or more governments.

B) Two related taxpayers.

C) The taxpayer and the IRS.

D) The IRS and U.S. taxing authorities.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

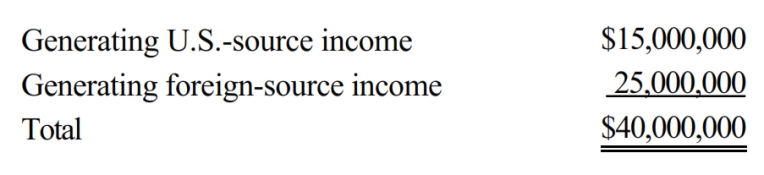

Goolsbee, Inc., a U.S. corporation, generates U.S.-source and foreign-source gross income. Goolsbee's assets (tax basis) are as follows.

Goolsbee incurs interest expense of $200,000. Apportion interest expense to foreign-source income.

Goolsbee incurs interest expense of $200,000. Apportion interest expense to foreign-source income.

Correct Answer

verified

Correct Answer

verified

True/False

A domestic corporation is one whose assets are primarily located in the U.S. For this purpose, the primarily located test (greater than 50%) applies.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

ForCo, a foreign corporation, receives interest income of $50,000 from USCo, an unrelated domestic corporation. USCo historically has earned 79% of its gross income from active foreign-source business income. What amount of ForCo's interest income is U.S.-source?

A) $0

B) $10,500

C) $39,500

D) $50,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following situations requires the filing of an information return with the U.S. government?

A) A domestic corporation that is 25% or more foreign owned.

B) A foreign corporation carrying on a trade or business in the United States.

C) U.S. persons who acquire or dispose of an interest in a foreign partnership.

D) All of the above.

E) None of the above.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In working with the foreign tax credit, a U.S. corporation may be able to alleviate the problem of excess foreign taxes by:

A) Deducting the excess foreign taxes that do not qualify for the credit.

B) Repatriating more foreign income to the United States in the year there is an excess limitation.

C) Generating "same basket" foreign-source income that is subject to a tax rate higher than the U.S. tax rate.

D) Generating "same basket" foreign-source income that is subject to a tax rate lower than the U.S. tax rate.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dark, Inc., a U.S. corporation, operates Dunkel, an unincorporated branch manufacturing operation in Germany. Dark reports $100,000 of taxable income from Dunkel on its U.S. tax return, along with $400,000 of taxable income from its U.S. operations. Dark paid $30,000 in German income taxes related to the $100,000 of Dunkel income. Assuming a U.S. tax rate of 21%, what is Dark's U.S. tax liability after any allowable foreign tax credits?

A) $21,000

B) $75,000

C) $84,000

D) $105,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

Match the definition with the correct term. a. Inbound b. Outbound c. Allocation and apportionment d. Qualified business unit e. Tax haven f. Income tax treaty g. Section 482 -Method for sourcing income and deductions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax haven often is:

A) A country with high internal income taxes.

B) A country with no or low internal income taxes.

C) A country without income tax treaties.

D) A country that prohibits "treaty shopping."

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding foreign persons not engaged in a U.S. trade or business is true?

A) Foreign persons are subject to potential withholding taxes on the gross amount of U.S.-source investment income.

B) Foreign persons with any U.S.-source income are taxed on net investment income (after expenses) .

C) Foreign persons are not subject to U.S. tax if not engaged in a U.S. trade or business.

D) Foreign persons with only U.S.-source investment income are exempt from U.S. tax.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Section 482 is used by the Treasury to:

A) Force taxpayers to use arms-length transfer pricing on transactions between related parties.

B) Reallocate income, deductions, etc., to a related taxpayer to minimize tax liability.

C) Increase information that is reported about U.S. corporations with non-U.S. owners.

D) All of the above.

E) None of the above.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Jokerz, a CFC of a U.S. parent, generated $80,000 Subpart F foreign base company services income in its first year of operations. The next year, Jokerz distributes $50,000 cash to the parent, from those service profits. The parent is taxed on $0 in the first year (tax deferral rules apply) and $50,000 in the second year.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Match the definition with the correct term. a. Expatriate b. Resident c. Nonresident alien d. U.S. trade or business e. Branch profits tax f. Effectively connected income -Individual who is not a U.S. citizen or resident.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 146

Related Exams