A) $80,000

B) $70,000

C) $100,000

D) $107,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Land differs from other property because it is not subject to depreciation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Monroe Minerals Company purchased a copper mine for $120,000,000.The mine was expected to produce 50,000 tons of copper over its useful life.During Year 1,the company extracted 6,000 tons of copper.The copper was sold for $4,500 per ton.Assume that the company incurred $8,040,000 in operating expenses during Year 1.What is the amount of net income for Year 1?

A) $12,600,000

B) $4,560,000

C) $6,360,000

D) $14,400,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

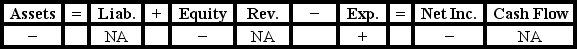

Byrd Company experienced an accounting event that affected the elements of its financial statements as indicated below:

Which of the following accounting events could have caused these effects?

Which of the following accounting events could have caused these effects?

A) Recognized depletion expense under the units-of-production method.

B) Recognized depreciation expense under the double-declining-balance method.

C) Amortized patent cost under the straight-line method.

D) All of these answer choices are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following terms is used to identify the expense recognition associated with intangible assets?

A) Allocation

B) Depletion

C) Depreciation

D) Amortization

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be classified as a long-term operational asset?

A) Notes receivable

B) Trademark

C) Inventory

D) Accounts receivable

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Dinwiddie Company purchased a car that cost $45,000.The car has an expected useful life of 5 years and a $10,000 salvage value.Which of the following statements is true?

A) The total amount of depreciation expense recognized over the six-year useful life will be greater under the double-declining-balance method than the straight-line method.

B) The amount of depreciation expense recognized in Year 4 would be greater if Dinwiddie depreciates the car under the straight-line method than if the double-declining-balance method is used.

C) At the end of Year 2,the amount in accumulated depreciation account will be less if the double-declining-balance method is used than it would be if the straight-line method is used.

D) None of these statements is true.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is considered an accelerated depreciation method?

A) Double-declining balance

B) Units-of-production

C) MACRS

D) Both double-declining-balance and MACRS

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be classified as a tangible long-term asset?

A) Delivery truck

B) Timber reserve

C) Land

D) Copyright

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tyler Company purchased equipment that cost $260,000 cash on January 1,Year 1.The equipment had an expected useful life of five years and an estimated salvage value of $10,000.Tyler depreciates its assets under the straight-line method.What is the amount of depreciation expense appearing on the Year 1 income statement?

A) $26,000

B) $50,000

C) $52,000

D) $100,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Recognizing depreciation expense on equipment or a building is an asset use transaction.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A trademark is a tangible asset with an indefinite useful life.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On March 1,Bartholomew Company purchased a new stamping machine with a list price of $34,000.The company paid cash for the machine;therefore,it was allowed a 5% discount.Other costs associated with the machine were: transportation costs,$550;sales tax paid,$1,360;installation costs,$450;routine maintenance during the first month of operation,$500.What is the cost of the machine?

A) $34,210

B) $32,300

C) $35,160

D) $34,660

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,XYZ Company paid $60,000 cash to purchase a truck.The truck has a $5,000 salvage value and a 4-year useful life.XYZ uses the double-declining-balance method.How much depreciation expense would XYZ report on its Year 2 income statement?

A) $13,750

B) $15,000

C) $20,000

D) $30,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,the City Taxi Company purchased a new taxi cab for $36,000.The cab has an expected salvage value of $2,000.The company estimates that the cab will be driven 200,000 miles over its life.It uses the units-of-production method to determine depreciation expense.The cab was driven 45,000 miles the first year and 48,000 the second year.What is the amount of depreciation expense reported on the Year 2 income statement and the book value of the taxi at the end of Year 2,respectively?

A) $8,640 and $19,260

B) $8,640 and $17,260

C) $8,160 and $20,190

D) $8,160 and $18,190

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The cost of natural resources includes the purchase price,as well as exploration costs and surveys.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance sheet of Flo's Restaurant showed total assets of $600,000,liabilities of $160,000 and stockholders' equity of $540,000.An appraiser estimated the fair value of the restaurant assets at $680,000.If Alice Company pays $770,000 cash for the restaurant,what is the amount of goodwill?

A) $90,000

B) $170,000

C) $250,000

D) $230,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The term used to recognize expense for property,plant,and equipment assets is depletion.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A copyright is an intangible asset with an indefinite useful life.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When using the modified accelerated cost recovery system (MACRS)the highest amount of depreciation expense will be recognized in the year the asset is acquired.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 110

Related Exams