B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A partnership may make an optional election to adjust the basis of its property on a distribution to a partner which liquidates the partner's entire interest in the partnership.If such an election is in effect,the partnership:

A) Generally applies the election to transfers that take place at any later date,unless the election is revoked.

B) Only adjusts the basis of its property for differences in basis between that of the partnership and a distributee partner if a transferor-transferee situation arises within two years after the distribution.

C) Increases the basis of similar retained assets when a distributee partner takes a basis which is greater than the partnership's basis in these assets,assuming the partnership does not have any receivables or inventory.

D) Decreases the basis of similar retained assets when the distributee partner recognizes gain on the distribution.

E) All of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

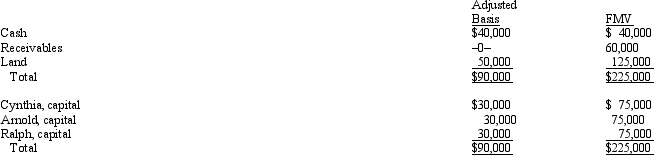

Cynthia sells her 1/3 interest in the CAR Partnership to Brandon for $95,000 cash.On the date of sale,the partnership balance sheet and agreed-upon fair market values were as follows:  If the partnership has a § 754 election in effect,the total "step-up" in basis of partnership assets that will be allocated to Brandon is:

If the partnership has a § 754 election in effect,the total "step-up" in basis of partnership assets that will be allocated to Brandon is:

A) $75,000.

B) $65,000.

C) $45,000.

D) $20,000.

E) $0.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Loss will be recognized on any distribution from a partnership in which cash,unrealized receivables and/or appreciated inventory are the only items distributed.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year,Darby contributed land (basis of $60,000,fair market value of $80,000) to the Seagull LLC in exchange for a 25% interest in the LLC.In the current year,the LLC distributes the land (now worth $82,000) to Shelby,who is also a 25% owner.Immediately prior to the distribution,Darby's basis in the LLC was $70,000,while Shelby's basis in the LLC was $110,000.How much gain or loss must be recognized and by whom? What is Shelby's basis in the property she receives and Darby's basis in her partnership interest following the distribution?

A) No gain or loss;Shelby's basis in the property is $80,000;Darby's basis in interest is $70,000.

B) $20,000 gain recognized by Darby;Shelby's basis in the property is $80,000;Darby's basis in interest is $90,000.

C) $22,000 gain recognized by Darby;Shelby's basis in the property is $82,000;Darby's basis in interest is $92,000.

D) $20,000 gain recognized by Shelby;Shelby's basis in the property is $80,000;Darby's basis in interest is $90,000.

E) $22,000 gain recognized by Shelby;Shelby's basis in the property is $82,000;Darby's basis in interest is $92,000.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nicholas is a 25% owner in the DDBN LLC (a calendar year entity) .At the end of the last tax year,Nicholas's basis in his interest was $50,000,including his $20,000 share of LLC liabilities.On July 1 of the current tax year,Nicholas sells his LLC interest to Anna for $80,000 cash.In addition,Anna assumes Nicholas's share of LLC liabilities,which,at that date,was $15,000.During the current tax year,DDBN's taxable income is $120,000 (earned evenly during the year) .Nicholas's share of the LLC's unrealized receivables is valued at $6,000 ($0 basis) .At the sale date,what is Nicholas's basis in his LLC interest,how much gain or loss must he recognize,and what is the character of the gain or loss?

A) $45,000 basis;$6,000 ordinary income;$44,000 capital gain.

B) $60,000 basis;$6,000 ordinary income;$29,000 capital gain.

C) $60,000 basis;$35,000 capital gain.

D) $75,000 basis;$0 ordinary income;$20,000 capital gain.

E) $75,000 basis;$6,000 ordinary income;$14,000 capital gain.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A disproportionate distribution arises when the partnership distributes a share of partnership hot assets to one or more partners that is not the same as the partner's ownership interest in the partnership.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

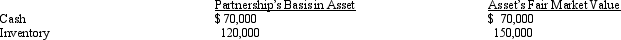

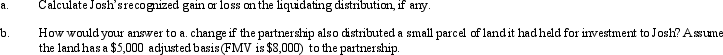

Josh has a 25% capital and profits interest in the calendar-year GDJ Partnership.His adjusted basis for his partnership interest on October 15 of the current year is $300,000.On that date,the partnership liquidates and makes a proportionate distribution of the following assets to Josh.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jonathon owns a one-third interest in a liquidating partnership.Immediately before the liquidation,Jonathon's basis in the partnership interest is $60,000.The partnership distributes cash of $32,000 and two parcels of land (each with a fair market value of $10,000) .Parcel A has a basis of $2,000 to the partnership and Parcel B has a basis of $6,000.Jonathon's basis in the two parcels of land is:

A) Parcel A,$2,000;Parcel B,$6,000.

B) Parcel A,$7,000;Parcel B,$21,000.

C) Parcel A,$10,000;Parcel B,$10,000.

D) Parcel A,$14,000;Parcel B,$14,000.

E) Parcel A,$15,000;Parcel B,$45,000.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A partnership has accounts receivable with a basis of $0 and a fair market value of $20,000 and depreciation recapture potential of $30,000.All other assets of the partnership are either cash,capital assets,or § 1231 assets.If a purchaser acquires a 40% interest in the partnership from another partner,the selling partner will be required to recognize ordinary income of $20,000.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

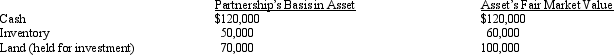

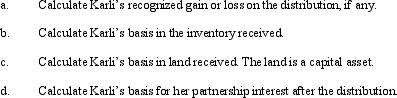

Karli owns a 25% capital and profits interest in the calendar-year KJDV Partnership.Her adjusted basis for her partnership interest on July 1 of the current year is $200,000.On that date,she receives a proportionate nonliquidating distribution of the following assets:

Correct Answer

verified

Correct Answer

verified

True/False

Several years ago,the Jaymo Partnership purchased 2,000 shares of ABCO stock (publicly traded)for $40,000;the stock now has a fair market value of $90,000.If this stock is distributed to Jason in liquidation of his 30% partnership interest,it is treated as a cash distribution of $75,000 and a property distribution of $15,000.Assume Jaymo owns no other securities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A partnership is required to make a downward adjustment to the basis of its assets if a partnership interest is sold and if the total decline in value of partnership assets is more than $250,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Marcie is a 40% member of the M&A LLC.Her basis is $10,000 immediately before the LLC distributes to her $30,000 of cash and land (basis to the LLC of $20,000 and fair market value of $25,000).As a result of the proportionate,nonliquidating distribution,Marcie recognizes a gain of $20,000 and her basis in the land is $0.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true regarding the sale of a partnership interest?

A) The selling partner's share of partnership liabilities is disregarded in determining the proceeds from the sale of a partnership interest.

B) For purposes of computing the selling partner's gain or loss,the partner's basis in the partnership interest is determined as of the last day of the partnership tax year ending before the year in which the interest is sold.

C) If a partner sells an interest in a partnership,income related to that interest for the year of the sale is allocated to the purchaser.

D) The selling partner could be required to report both ordinary income and a capital loss on sale of the partnership interest.

E) The partner's share of partnership "hot assets" is disregarded in determining the character of the partner's gain on the sale of the partnership interest.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Anthony's basis in the WAM Partnership interest was $200,000 just before he received a proportionate liquidating distribution consisting of investment land (basis of $90,000,fair market value of $100,000) ,and inventory (basis of $30,000,fair market value of $70,000) .After the distribution,Anthony's recognized gain or loss and his basis in the land and inventory are:

A) $80,000 loss;$90,000 (land) ;$30,000 (inventory) .

B) $70,000 loss;$100,000 (land) ;$30,000 (inventory) .

C) $30,000 loss;$100,000 (land) ;$70,000 (inventory) .

D) $0 gain or loss;$170,000 (land) ;$30,000 (inventory) .

E) None of the above.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Landon received $50,000 cash and a capital asset (basis of $70,000,fair market value of $80,000) in a proportionate liquidating distribution.His basis in his partnership interest was $100,000 prior to the distribution.How much gain or loss does Landon recognize and what is his basis in the asset received?

A) $0 gain or loss;$70,000 basis.

B) $0 gain or loss;$50,000 basis.

C) $20,000 gain;$70,000 basis.

D) $30,000 gain;$70,000 basis.

E) $30,000 gain;$80,000 basis.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 97 of 97

Related Exams