A) $0.

B) $15,000.

C) $25,000.

D) $525,000.

E) None of the above.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If a taxpayer exchanges like-kind property under § 1031 and assumes a liability associated with the property received, the taxpayer is considered to have given boot in the transaction.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The holding period for property acquired by gift is automatically long term.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Gene purchased an SUV for $42,000 which he uses 100% for personal purposes.When the SUV is worth $29,000, he contributes it to his business.The gain basis is $42,000, the loss basis is $29,000, and the basis for cost recovery is $29,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Joyce's office building was destroyed in a fire (adjusted basis of $350,000; fair market value of $400,000) . Of the insurance proceeds of $360,000 she receives, Joyce uses $310,000 to purchase additional inventory and invests the remaining $50,000 in short-term certificates of deposit. She received only $360,000 because of a co-insurance clause in her insurance policy. What is Joyce's recognized gain or loss?

A) $0.

B) $10,000 loss.

C) $10,000 gain.

D) $40,000 gain.

E) None of the above.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Purchased goodwill is assigned a basis equal to cost, and developed or self-created goodwill is assigned a basis equal to one-fifteenth of the amount expended.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

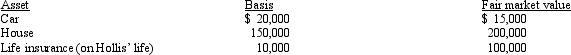

Henrietta and Hollis have been married for 10 years when Hollis dies in a sky-diving accident.Their assets are summarized below.  Henrietta and Hollis reside in Wisconsin, a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Car House Cash from life insurance proceeds

Henrietta and Hollis reside in Wisconsin, a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Car House Cash from life insurance proceeds

A) $20,000 $150,000 $ 10,000

B) $17,500 $175,000 $ 10,000

C) $17,500 $175,000 $100,000

D) $15,000 $200,000 $100,000

E) None of the above.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following satisfy the time period requirement for postponement of gain as a § 1033 (nonrecognition of gain from an involuntary conversion) involuntary conversion?

A) Al's business warehouse is destroyed by a tornado on October 31, 2012.Al is a calendar year taxpayer.He receives insurance proceeds on December 5, 2012.He reinvests the proceeds in another warehouse to be used in his business on December 29, 2014.

B) Heather's personal residence is destroyed by fire on October 31, 2012.She is a calendar year taxpayer.She receives insurance proceeds on December 5, 2012.She purchases another principal residence with the proceeds on October 31, 2014.

C) Mack's office building is condemned by the city as part of a road construction project.The date of the condemnation is October 31, 2012.He is a calendar year taxpayer.He receives condemnation proceeds from the city on that date.He purchases another office building with the proceeds on December 5, 2015.

D) Lizzy's business automobile is destroyed in an accident on October 31, 2012.Lizzy is a fiscal year taxpayer with the fiscal year ending on June 30th.She receives insurance proceeds on December 5, 2012.She purchases another business automobile with the proceeds on June 1, 2015.

E) All of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If boot in the form of cash is given in a § 1031 like-kind exchange, the realized gain may be recognized.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ashley sells real property for $280,000.The buyer pays $4,000 in property taxes that had accrued during the year while the property was still legally owned by Ashley.In addition, Ashley pays $14,000 in commissions and $3,000 in legal fees in connection with the sale.How much does Ashley realize (the amount realized) from the sale of her property?

A) $259,000.

B) $263,000.

C) $267,000.

D) $280,000.

E) None of the above.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In determining the basis of like-kind property received, postponed losses are:

A) Added to the basis of the old property.

B) Subtracted from the basis of the old property.

C) Added to the fair market value of the like-kind property received.

D) Subtracted from the fair market value of the like-kind property received.

E) None of the above.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A condemned office building owned and used in the business by a taxpayer can be replaced by land and qualify for nonrecognition treatment.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The taxpayer can elect to have the exclusion of gain under § 121 (sale of principal residence) not apply.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On October 1, Paula exchanged an apartment building (adjusted basis of $375,000 and subject to a mortgage of $125,000) for another apartment building owned by Nick (fair market value of $550,000 and subject to a mortgage of $125,000) .The property transfers were made subject to the mortgages.What amount of gain should Paula recognize?

A) $0.

B) $25,000.

C) $125,000.

D) $175,000.

E) None of the above.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Molanda sells a parcel of land for $25,000 in cash and the buyer assumes Molanda's mortgage of $20,000 on the land.Molanda's amount realized is $45,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Alex used the § 121 exclusion three months prior to his marriage to June.If June sells her principal residence four months after their marriage, she cannot use the § 121 exclusion.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Karen owns City of Richmond bonds with a face value of $10,000.She purchased the bonds on January 1, 2012, for $11,000.The maturity date is December 31, 2021.The annual interest rate is 8%.What is the amount of taxable interest income that Karen should report for 2012, and the adjusted basis for the bonds at the end of 2012, assuming straight-line amortization is appropriate?

A) $0 and $11,000.

B) $0 and $10,900.

C) $100 and $11,000.

D) $100 and $10,900.

E) None of the above.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If boot is received in a § 1031 like-kind exchange and gain is recognized, which formula correctly calculates the basis for the like-kind property received?

A) Adjusted basis of like-kind property surrendered + gain recognized - fair market value of boot received.

B) Fair market value of like-kind property surrendered + gain recognized - fair market value of boot received.

C) Fair market value of like-kind property received - postponed gain.

D) Only a.and c.

E) None of the above.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alicia buys a beach house for $425,000 which she uses as her personal vacation home.She builds an additional room on the house for $45,000.She sells the property for $510,000 and pays $30,000 in commissions and $4,000 in legal fees in connection with the sale.What is the recognized gain or loss on the sale of the house?

A) $0.

B) $6,000.

C) $30,000.

D) $40,000.

E) None of the above.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A factory building owned by Amber, Inc.is destroyed by a hurricane.The adjusted basis of the building was $400,000 and the appraised value was $425,000.Amber receives insurance proceeds of $390,000.A factory building is constructed during the nine-month period after the hurricane at a cost of $450,000.What is the recognized gain or loss and what is the basis of the new factory building?

A) $0 and $450,000.

B) $0 and $460,000.

C) ($10,000) and $440,000.

D) ($10,000) and $450,000.

E) None of the above.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 200

Related Exams