B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Generally, deductions for additions to reserves for estimated future costs (e.g., an allowance for estimated warranty costs) are not allowed for Federal income tax purposes because allowing the deduction would:

A) Result in a mismatching of revenues and expenses.

B) Violate established public policy.

C) Violate the economic performance requirement.

D) Violate the tax benefit rule.

E) None of the above.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A calendar year, cash basis corporation began business on April 1, 2012, and paid $2,400 for a 24-month liability insurance policy. An accrual basis, calendar year taxpayer also began business on April 1, 2012, and purchased a 24-month liability insurance policy. Both the cash basis and accrual basis taxpayers' deduction for insurance expense on the policy for 2012 is $900 (9/12 ´ $1,200).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

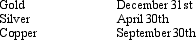

Gold Corporation, Silver Corporation, and Copper Corporation are equal partners in the GSC Partnership.The partners' tax year-ends are as follows:

A) The partnership is free to elect any tax year.

B) The partnership may use any of the 3 year-end dates that its partners use.

C) The partnership must use a September 30th year-end.

D) The partnership must use a April 30th year-end.

E) None of the above.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Sandstone, Inc., has consistently included some factory overhead as a current expense, rather than as a cost of producing goods.As a result, the beginning inventory for 2012 is understated by $40,000.If Sandstone voluntarily changes accounting methods effective January 1, 2012, the positive adjustment to the inventory is a § 481 adjustment and $10,000 must be added to taxable income for each year 2012, 2013, 2014, and 2015.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In 2012, T Corporation changed its tax year from ending each September 30th to ending each December 31st. The corporation earned $25,000 during the period October 1, 2012 through December 31, 2012. The tax on the annualized income for the short period will be greater than the tax on $25,000 when the tax rates are progressive.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the case of a small home construction company that builds under long-term contracts, generally:

A) The percentage of completion method is required to report the income from the construction contracts.

B) The percentage of completion method can be elected and generally will defer income until the contract is completed.

C) The completed contract method can be used and generally will defer income.

D) The accrual method must be used because inventories are an income-producing factor.

E) None of the above is true.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 87 of 87

Related Exams