Filters

Question type

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 82

True/False

By making a water's edge election, the multinational taxpayer can limit the reach of unitary principles to the apportionment factors and income of its U.S.and E.U.affiliates.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 83

Multiple Choice

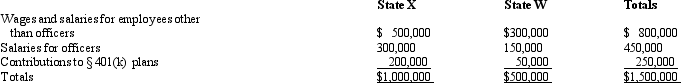

Trayne Corporation's sales office and manufacturing plant are located in State X.Trayne also maintains a manufacturing plant and sales office in State W.For purposes of apportionment, X defines payroll as all compensation paid to employees, including elective contributions to § 401(k) deferred compensation plans.Under the statutes of W, neither compensation paid to officers nor contributions to § 401(k) plans are included in the payroll factor.Trayne incurred the following personnel costs.  Trayne's payroll factor for State X is:

Trayne's payroll factor for State X is:

A) 100.00%.

B) 66.67%.

C) 62.50%.

D) 50.00%.

E) All of the above

F) A) and B)

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Question 84

True/False

Typically exempt from the sales/use tax base is the purchase of tools by a manufacturer to make the widgets that it sells.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 85

Essay

Identify some state/local income tax issues facing pass-through entities such as S corporations, partnerships, and LLCs.

Correct Answer

verified

Correct Answer

verified

Showing 141 - 145 of 145

Related Exams