A) repeal an investment tax credit or increase the money supply

B) repeal an investment tax credit or decrease the money supply

C) institute an investment tax credit or increase the money supply

D) institute an investment tax credit or decrease the money supply

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the price level falls,then

A) the interest rate falls and spending on goods and services falls.

B) the interest rate falls and spending on goods and services rises.

C) the interest rate rises and spending on goods and services falls.

D) the interest rate rises and spending on goods and services rises.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest rate would fall and the quantity of money demanded would

A) increase if there were a surplus in the money market.

B) increase if there were a shortage in the money market.

C) decrease if there were a surplus in the money market.

D) decrease if there were a shortage in the money market.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the MPC is 0.75.Assuming only the multiplier effect matters,a decrease in government purchases of $100 billion will shift the aggregate demand curve to the

A) left by $200 billion.

B) left by $400 billion.

C) right by $800 billion.

D) None of the above is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the early 1960s,the Kennedy administration made considerable use of

A) fiscal policy to stimulate the economy.

B) fiscal policy to slow down the economy.

C) monetary policy to stimulate the economy.

D) monetary policy to slow down the economy.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The theory of liquidity preference was developed by Irving Fisher.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which particular interest rate(s) do we attempt to explain using the theory of liquidity preference?

A) only the nominal interest rate

B) both the nominal interest rate and the real interest rate

C) only the interest rate on long-term bonds

D) only the interest rate on short-term government bonds

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The multiplier for changes in government spending is calculated as

A) 1/MPC.

B) 1/(1 - MPC) .

C) MPC/(1 - MPC) .

D) (1 - MPC) /MPC.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

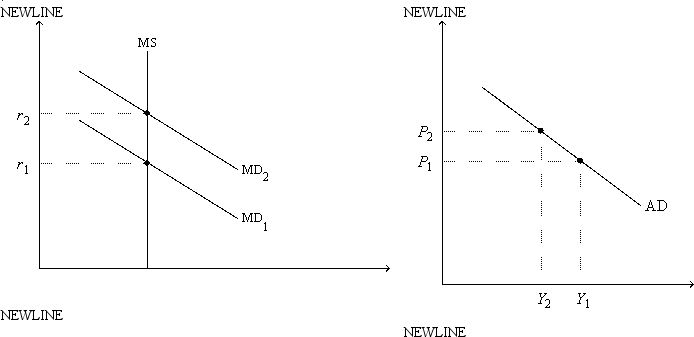

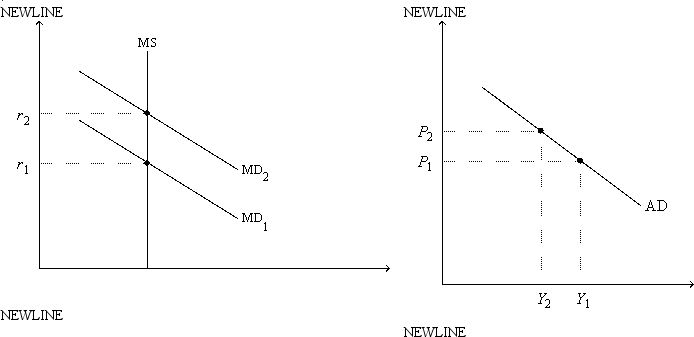

Figure 34-2.On the left-hand graph,MS represents the supply of money and MD represents the demand for money;on the right-hand graph,AD represents aggregate demand.The usual quantities are measured along the axes of both graphs.

-Refer to Figure 34-2.Assume the money market is always in equilibrium,and suppose r1 = 0.08;r2 = 0.12;Y1 = 13,000;Y2 = 10,000;P1 = 1.0;and P2 = 1.2.Which of the following statements is correct? When P = P2,

-Refer to Figure 34-2.Assume the money market is always in equilibrium,and suppose r1 = 0.08;r2 = 0.12;Y1 = 13,000;Y2 = 10,000;P1 = 1.0;and P2 = 1.2.Which of the following statements is correct? When P = P2,

A) investment is lower than it is when P = P1.

B) nominal output is higher than it is when P = P1.

C) the expected rate of inflation is higher than it is when P = P1.

D) the velocity of money is higher than it is when P = P1.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements generates the greatest amount of disagreement among economists?

A) Increases in the money supply shift aggregate demand to the right.

B) In the long run,increases in the money supply increase prices,but not output.

C) Recessions are associated with decreases in consumption,investment,and employment.

D) Government should use fiscal policy to try to stabilize the economy.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If,at some interest rate,the quantity of money demanded is greater than the quantity of money supplied,people will desire to

A) sell interest-bearing assets,causing the interest rate to decrease.

B) sell interest-bearing assets,causing the interest rate to increase.

C) buy interest-bearing assets,causing the interest rate to decrease.

D) buy interest-bearing assets,causing the interest rate to increase.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most extreme example of a temporary tax cut was the one announced in 1992 by President George H.W.Bush.The effect of that tax cut on consumer spending and aggregate demand was

A) zero.

B) likely smaller than if the cut had been permanent.

C) likely about the same as if the cut had been permanent.

D) likely larger than if the cut had been permanent.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the liquidity-preference model,when the Federal Reserve increases the money supply,

A) the equilibrium interest rate decreases.

B) the aggregate-demand curve shifts to the left.

C) the quantity of goods and services demanded is unchanged for a given price level.

D) the long-run aggregate-supply curve shifts to the right.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For the U.S.economy,which of the following is the most important reason for the downward slope of the aggregate-demand curve?

A) the wealth effect

B) the interest-rate effect

C) the exchange-rate effect

D) the real-wage effect

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Both the multiplier effect and the investment accelerator tend to make the aggregate-demand curve shift further than it does due to an initial increase in government expenditures.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Fed is concerned about stock market booms because the booms

A) increase consumption spending.

B) increase investment spending.

C) increase both consumption and investment spending.

D) None of the above is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 34-2.On the left-hand graph,MS represents the supply of money and MD represents the demand for money;on the right-hand graph,AD represents aggregate demand.The usual quantities are measured along the axes of both graphs.

-Refer to Figure 34-2.As we move from one point to another along the money-demand curve MD1,

-Refer to Figure 34-2.As we move from one point to another along the money-demand curve MD1,

A) the price level is held fixed at P1.

B) the interest rate is held fixed at r1.

C) the money supply is changing so as to keep the money market in equilibrium.

D) the expected inflation rate is changing so as to keep the real interest rate constant.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An implication of the Employment Act of 1946 is that the government should respond to changes in the private economy to stabilize aggregate demand.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most important automatic stabilizer is

A) open-market operations.

B) the tax system.

C) unemployment compensation.

D) welfare benefits.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Keynes used the term "animal spirits" to refer to

A) policy makers harming the economy in the pursuit of self interest.

B) arbitrary changes in attitudes of household and firms.

C) mean-spirited economists who believed in the classical dichotomy.

D) firms' relentless efforts to maximize profits.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 241 - 260 of 334

Related Exams