A) increase U.S.net capital outflow and have no affect on Greek net capital outflow.

B) increase U.S.net capital outflow and increase Greek net capital outflow.

C) increase U.S.net capital outflow,but decrease Greek net capital outflow.

D) decrease U.S.net capital outflow,but increase Greek net capital outflow.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the exchange rate is .70 euro per dollar,the price of an MP3 player in Paris is 150 euros and the price of an MP3 player in the U.S.is $150,then what is the real exchange rate?

A) 1/.70 French MP3 players per U.S.MP3 player

B) 1 French MP3 players per U.S.MP3 player

C) .70 French MP3 players per U.S.MP3 player.

D) None of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the real exchange rate is 1/2 gallon of Canadian gasoline per gallon of U.S.gasoline,a gallon of U.S.gasoline costs $5.00 U.S. ,and a gallon of Canadian gas costs 8 Canadian dollars.What is the nominal exchange rate?

A) .80 Canadian dollars per U.S.dollar

B) 1.25 Canadian dollars per U.S.dollar

C) 1.60 Canadian dollars per U.S.dollar

D) None of the above is correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the exchange rate is 125 yen = $1,a bottle of rice wine that costs 2,500 yen costs

A) $20.

B) $25.

C) $22.

D) None of the above is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Purchasing-power parity theory does not hold at all times because

A) many goods are not easily transported.

B) the same goods produced in different countries may be imperfect substitutes for each other.

C) Both a and b are correct.

D) prices are different across countries.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of U.S.foreign direct investment?

A) A U.S.based mutual fund buys stock in Eastern European companies.

B) A U.S.citizen builds and operates a coffee shop in the Netherlands.

C) A Swiss bank buys a U.S.government bond.

D) A German tractor factory opens a plant in Waterloo,Iowa.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following events would be consistent with purchasing-power parity?

A) The price level in the United States rises more rapidly than that in Ireland and the real exchange rate defined as Irish goods per unit of U.S.goods stays the same.

B) The money supply in the United States rises more rapidly than in Egypt and the nominal exchange rate defined as Egyptian pounds per dollar falls.

C) Earl,a worldwide traveler,looks at exchange rates and worldwide breakfast prices one morning and finds that whatever country he decides to go to he can convert $5 into enough local currency to buy the same breakfast.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net capital outflow equals the difference between a country's

A) income and expenditure.

B) investment and saving.

C) buying of foreign goods and services and sales of goods and services abroad.

D) purchases of foreign assets and sales of domestic assets abroad.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During some year a country had exports of $30 billion,imports of $40 billion,and domestic investment of $60 billion.What was its saving during the year?

A) $70 billion

B) $50 billion

C) $10 billion

D) -$10 billion

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When net capital outflow is negative,it means that on net the value of domestic assets purchased by foreigners exceeds the value of foreign assets purchased by domestic residents.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to purchasing power parity,if the same basket of goods costs $100 in the U.S.and 50 pounds in Britain,then what is the nominal exchange rate?

A) 2 pounds per dollar

B) 1 pound per dollar

C) 1/2 pound per dollar

D) None of the above is correct

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a U.S.shirt maker purchases cotton from Egypt,U.S.net exports

A) increase,and U.S.net capital outflow increases.

B) increase,and U.S.net capital outflow decreases.

C) decrease,and U.S.net capital outflow increases.

D) decrease,and U.S.net capital outflow decreases.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Since 1950 U.S.exports as a percentage of GDP have approximately

A) stayed constant.

B) doubled.

C) tripled.

D) quadrupled.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a country has negative net capital outflows,then its net exports are

A) positive and its saving is larger than its domestic investment.

B) positive and its saving is smaller than its domestic investment.

C) negative and its saving is larger than its domestic investment.

D) negative and its saving is smaller than its domestic investment.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Japan's national saving exceeds its domestic investment,then Japan has

A) positive net capital outflows and negative net exports.

B) positive net capital outflows and positive net exports.

C) negative net capital outflows and negative net exports.

D) negative net capital outflows and positive net exports.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

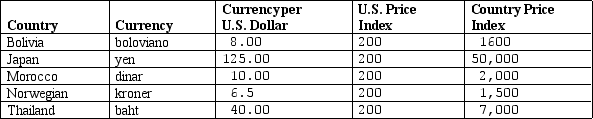

Table 31-2

-Refer to Table 31-2.In real terms,U.S.goods are more expensive than goods in which country(ies) ?

-Refer to Table 31-2.In real terms,U.S.goods are more expensive than goods in which country(ies) ?

A) Bolovia and Morocco

B) Japan,Norway,and Thailand

C) Japan and Norway

D) Thailand

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a nation is selling more goods and services to foreigners than it is buying from them,then on net it must be selling assets abroad.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During a hyperinflation the real domestic value of a country's currency

A) falls and its nominal exchange rate depreciates.

B) falls and its nominal exchange rate appreciates.

C) rises and its nominal exchange rate depreciates.

D) rises and its nominal exchange rate appreciates.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the U.S.a candy bar costs $1.The nominal exchange rate is 6 Chinese yuan per dollar.If the real exchange rate is 1.2,then,what is the price of a candy bar in China?

A) 7.2 yuan

B) 6 yuan

C) 5 yuan

D) 3.6 yuan

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are the CEO of a U.S.firm considering building a factory in Chile.If the dollar appreciates relative to the Chilean peso,then other things the same

A) it takes fewer dollars to build the factory.By itself building the factory increases U.S.net capital outflow.

B) it takes fewer dollars to build the factory.By itself building the factory decreases U.S.net capital outflow.

C) it takes more dollars to build the factory.By itself building the factory increases U.S.net capital outflow.

D) it takes more dollars to build the factory.By itself building the factory decreases U.S.net capital outflow.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 346

Related Exams