A) National defense

B) Social Security

C) Income security

D) Farm support programs

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on all forms of income will

A) lower the effective rate of interest on savings.

B) have no effect on savings.

C) enhance social welfare because the benefits will outweigh the costs.

D) enhance the incentives to save.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is justified on the basis that the taxpayers who pay the tax receive specific government services from payment of the tax,the tax

A) is considered horizontally equitable.

B) burden is minimized.

C) satisfies the benefits principle.

D) is considered vertically equitable.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

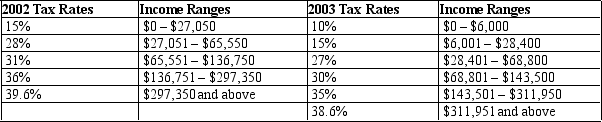

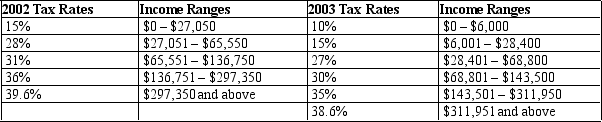

Table 12-12

United States Income Tax Rates for a Single Individual,2002 and 2003.

-Refer to Table 12-12.Samantha is a single person whose taxable income is $100,000 a year.What happened to her marginal tax rate between 2002 and 2003?

-Refer to Table 12-12.Samantha is a single person whose taxable income is $100,000 a year.What happened to her marginal tax rate between 2002 and 2003?

A) It increased.

B) It decreased.

C) It did not change.

D) We do not have enough information to answer this question.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The marginal tax rate serves as a measure of the extent to which the tax system discourages people from working.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When compared to nonpoor countries,poor countries usually have

A) very high tax burdens.

B) similar tax burdens.

C) relatively low tax burdens.

D) no taxes because of high poverty levels.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

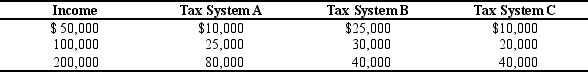

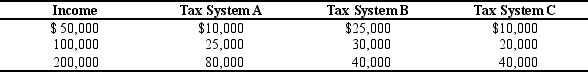

Table 12-15

The dollar amounts in the last three columns are the taxes owed under the three different tax systems.

-Suppose an excise tax is imposed on luxury boats and yachts.Economists argue that such a tax

-Suppose an excise tax is imposed on luxury boats and yachts.Economists argue that such a tax

A) is sure to be vertically equitable,since buyers of luxury boats and yachts are wealthy.

B) entails no deadweight loss as long as buyers of boats and yachts can easily substitute one luxury good for another.

C) violates the benefits principle of taxation.

D) may burden workers in the luxury-boat-and-yacht industry more than it burdens the buyers of luxury boats and yachts.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An advantage of a consumption tax over the present tax system is that a consumption tax

A) raises more revenues.

B) would save the government millions in administrative costs.

C) places more of the tax burden on the wealthy.

D) does not discourage saving.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

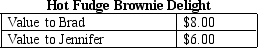

Table 12-4

-Refer to Table 12-4.Suppose that the government imposes a $2 tax on delights,causing the price to increase from $5.00 to $7.00.Total consumer surplus

-Refer to Table 12-4.Suppose that the government imposes a $2 tax on delights,causing the price to increase from $5.00 to $7.00.Total consumer surplus

A) falls by less than the tax revenue generated.

B) falls by more than the tax revenue generated.

C) falls by the same amount as the tax revenue generated.

D) will not fall since Jennifer will no longer be in the market.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The single largest expenditure by state and local governments is on

A) highways.

B) police.

C) public welfare.

D) education.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

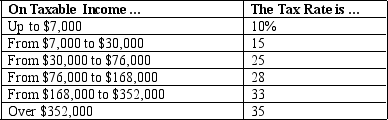

Table 12-1

-Refer to Table 12-1.If Barb has $126,000 in taxable income,her marginal tax rate is

-Refer to Table 12-1.If Barb has $126,000 in taxable income,her marginal tax rate is

A) 25%.

B) 28%.

C) 33%.

D) 35%.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Nebraska imposed a tax on milk of 10 cents per gallon,it would

A) be an excise tax.

B) be an income tax.

C) reduce tax revenue.

D) cause the supply of milk to rise.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Many economists believe that the U.S.tax system would be made more efficient if the basis of taxation were changed so that people paid taxes,more so than they do now,based on

A) their saving rather than their income.

B) their spending rather than their income.

C) their income rather than their wealth.

D) their wealth rather than their spending.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-15

The dollar amounts in the last three columns are the taxes owed under the three different tax systems.

-A lump-sum tax

-A lump-sum tax

A) is also a proportional tax.

B) entails larger deadweight losses than other types of taxes.

C) is the most efficient tax possible.

D) is the most equitable tax possible.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-1 Suppose Jim and Joan receive great satisfaction from their consumption of cheesecake.Joan would be willing to purchase only one slice and would pay up to $6 for it.Jim would be willing to pay $9 for his first slice,$7 for his second slice,and $3 for his third slice.The current market price is $3 per slice. -Refer to Scenario 12-1.Assume that the government places a $4 tax on each slice of cheesecake and that the new equilibrium price is $7.Which of the following statements is correct?

A) Jim will bear the full burden of the deadweight loss.

B) Joan will bear the full burden of the deadweight loss.

C) Both Joan and Jim will share the burden of the deadweight loss.

D) There will be no deadweight loss.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If your income is $40,000 and your income tax liability is $5,000,your

A) marginal tax rate is 8 percent.

B) average tax rate is 8 percent.

C) marginal tax rate is 12.5 percent.

D) average tax rate is 12.5 percent.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Country A's tax system is more efficient than Country B's tax system if

A) Country A collects less tax revenue than Country B,and the cost to taxpayers is the same in both countries.

B) Country A collects more tax revenue than Country B,even though the cost to taxpayers is greater in Country A than in Country B.

C) the same amount of revenue is raised in both countries,but the cost to taxpayers is smaller in Country A than in Country B.

D) the same amount of revenue is raised in both countries,but the taxes are collected in a shorter amount of time in Country A than in Country B.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Many people consider lump-sum taxes to be unfair to low-income taxpayers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-12

United States Income Tax Rates for a Single Individual,2002 and 2003.

-Refer to Table 12-12.Samantha is a single person whose taxable income is $100,000 a year.What is her marginal tax rate in 2003?

-Refer to Table 12-12.Samantha is a single person whose taxable income is $100,000 a year.What is her marginal tax rate in 2003?

A) 15%

B) 27%

C) 30%

D) 35%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2007,approximately what percentage of federal government receipts came from individual income taxes?

A) 15%

B) 30%

C) 45%

D) 60%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 397

Related Exams