A) 25%

B) 28%

C) 40%

D) 60%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-2 Suppose that Bob places a value of $10 on a movie ticket and that Lisa places a value of $7 on a movie ticket.In addition,suppose the price of a movie ticket is $5. -Refer to Scenario 12-2.What is total consumer surplus for Bob and Lisa?

A) $0

B) $2

C) $5

D) $7

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-2 Suppose that Bob places a value of $10 on a movie ticket and that Lisa places a value of $7 on a movie ticket.In addition,suppose the price of a movie ticket is $5. -Refer to Scenario 12-2.Suppose the government levies a tax of $1 on each movie ticket and that,as a result,the price of a movie ticket increases to $6.00.If Bob and Lisa both purchase a movie ticket,what is total consumer surplus for Bob and Lisa?

A) $0.00

B) $0.50

C) $5.00

D) $6.00

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to long-run projections,under current law,

A) federal government spending as a percentage of GDP will rise gradually but substantially in the next several decades.

B) federal taxes as a percentage of GDP will rise gradually but substantially in the next several decades.

C) the federal government's budget deficit will gradually be eliminated in the next several decades.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If your income is $50,000,your income tax liability is $10,000,and you paid $0.25 in taxes on the last dollar you earned,your

A) marginal tax rate is 20 percent.

B) average tax rate is 5 percent.

C) marginal tax rate is 25 percent.

D) average tax rate is 25 percent.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Medicare has been the focus of many proposed reforms over the last several years because

A) health care costs have risen more rapidly than the cost of other goods and services produced in the economy.

B) nationalized health care systems are more efficient than private health care systems.

C) cures for many major diseases are likely to be found in the next few years.

D) government health care research has found that limiting access to doctors will increase the general health of the population.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-1 Suppose Jim and Joan receive great satisfaction from their consumption of cheesecake.Joan would be willing to purchase only one slice and would pay up to $6 for it.Jim would be willing to pay $9 for his first slice,$7 for his second slice,and $3 for his third slice.The current market price is $3 per slice. -Refer to Scenario 12-1.Assume that the government places a $4 tax on each slice of cheesecake and that the new equilibrium price is $7.What is the deadweight loss of the tax?

A) $3

B) $6

C) $8

D) $9

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

State and local government spending on public welfare includes

A) trash removal.

B) transfer payments to the poor.

C) libraries.

D) road repairs.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

To fully understand the progressivity of government policies,one should only look at the proportion of total income that individuals pay in taxes each year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Medicaid is

A) the government's health plan for the elderly.

B) the government's health plan for the poor.

C) another name for Social Security.

D) Both a and c are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The deadweight loss of an income tax is determined by the

A) amount of total tax revenue to the government.

B) marginal tax rate.

C) average tax rate.

D) ability-to-pay principle.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a way that a corporate tax on the income of U.S.car companies will affect markets?

A) The price of cars will rise.

B) The wages of auto workers will fall.

C) Owners of car companies (stockholders) will receive less profit.

D) Less deadweight loss will occur since corporations are entities and not people who respond to incentives.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The two taxes that together provide the U.S.federal government with approximately 80 percent of its revenue are

A) individual income taxes and property taxes.

B) individual income taxes and corporate income taxes.

C) individual income taxes and payroll taxes.

D) sales taxes and payroll taxes.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

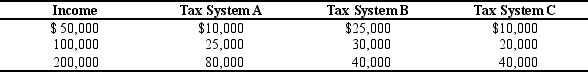

Table 12-15

The dollar amounts in the last three columns are the taxes owed under the three different tax systems.

-Refer to Table 12-15.Which of the three tax systems is progressive?

-Refer to Table 12-15.Which of the three tax systems is progressive?

A) Tax System A

B) Tax System B

C) Tax System C

D) All of the tax systems are progressive.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

As of 2005,the largest source of receipts for state and local governments was individual income taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a country imposes a lump-sum income tax of $5,000 on each individual in the country.What is the marginal income tax rate for an individual who earns $40,000 during the year?

A) 0%

B) 10%

C) More than 10%

D) The marginal tax rate cannot be determined without knowing the entire tax schedule.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nancy paid a tax of $0.50 on the last dollar she earned in 1999.Nancy's marginal tax rate in 1999 was

A) more than 50 percent.

B) exactly 50 percent.

C) higher than her average tax rate.

D) lower than her average tax rate.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

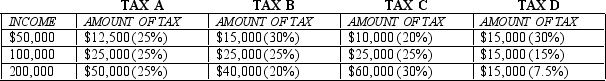

Table 12-17

-Refer to Table 12-17.A regressive tax is illustrated by tax

-Refer to Table 12-17.A regressive tax is illustrated by tax

A) A only.

B) B or D.

C) C only.

D) A or D.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S.federal government collects approximately what percentage of the taxes in the economy?

A) 10%

B) 40%

C) 50%

D) 67%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the most difficult issues associated with trying to structure a tax policy to satisfy horizontal equity is determining

A) whether or not a taxpayer falls within the highest income quintile.

B) the level of transfer payments made to low-income groups.

C) the source of income for taxpayers.

D) what differences are relevant to a family's ability to pay.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 397

Related Exams