B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) The U.S.tax burden is high compared to many poor countries.

B) As nations get richer,their governments typically collect a smaller share of income in taxes.

C) The U.S.has a higher federal tax burden than China and India.

D) The U.S.tax burden is low compared to many European countries.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deadweight losses are associated with

A) taxes that distort the incentives that people face.

B) taxes that target expenditures on survivor's benefits for Social Security.

C) taxes that have no efficiency losses.

D) lump-sum taxes.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

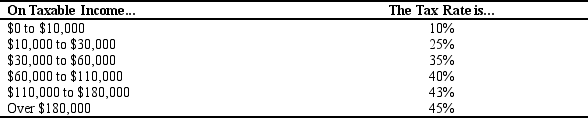

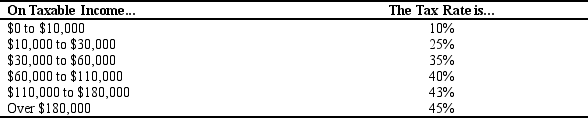

Table 12-9

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.

-Refer to Table 12-9.For this tax schedule,what is the total income tax due for an individual with $49,000 in taxable income?

-Refer to Table 12-9.For this tax schedule,what is the total income tax due for an individual with $49,000 in taxable income?

A) $12,650

B) $14,370

C) $15,960

D) $16,220

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-9

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.

-Refer to Table 12-9.For this tax schedule,what is the total tax liability for an individual with $280,000 in taxable income?

-Refer to Table 12-9.For this tax schedule,what is the total tax liability for an individual with $280,000 in taxable income?

A) $105,700

B) $108,900

C) $111,600

D) $117,300

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

State and local governments generate revenue from all of the following sources except

A) sales taxes.

B) the federal government.

C) corporate income taxes.

D) customs duties.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government imposes a tax of $3,000 on everyone,the tax would be

A) an income tax.

B) a consumption tax.

C) a lump-sum tax.

D) a marginal tax.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Today the typical American pays approximately what percent of income in taxes,including all federal,state,and local taxes?

A) 5 percent

B) 18 percent

C) 33 percent

D) 50 percent

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tax systems that impose record keeping requirements on taxpayers are said to have

A) an auditing burden.

B) a lower incidence of compliance.

C) an administrative burden.

D) a certification requirement.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Total taxes paid divided by total income is called the

A) lump-sum tax liability.

B) marginal tax rate.

C) average tax rate.

D) average consumption tax liability.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax system based on the ability-to-pay principle claims that all citizens should

A) pay taxes based on the benefits they receive from government services.

B) pay the same amount in taxes.

C) pay taxes based on consumption rather than income.

D) make an equal sacrifice.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following contributes to the projected rise in government spending on Social Security and Medicare as a percentage of GDP?

A) Increasing life expectancies

B) Falling fertility rates

C) Increasing health care costs

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The resources that a taxpayer devotes to complying with the tax laws are a type of

A) consumption tax.

B) value-added tax.

C) deadweight loss.

D) producer surplus.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S.federal government finances budget deficits by

A) selling stock,much like a corporation.

B) printing additional currency.

C) borrowing from the public.

D) raising property taxes.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The federal healthcare spending program that specifically targets the poor is called

A) Medicaid.

B) Medicare.

C) National Institutes of Health.

D) Blue Cross/Blue Shield.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Individual income taxes generate rougly 25% of the tax revenue for the federal government.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The federal taxes owed by a taxpayer depend

A) only upon the marginal tax rate on the taxpayer's first $25,000 of income.

B) only upon the marginal tax rate on the taxpayer's last $10,000 of income.

C) upon all the marginal tax rates up to the taxpayer's overall level of income.

D) upon all the marginal tax rates,including those for income levels that exceed the taxpayer's overall level of income.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

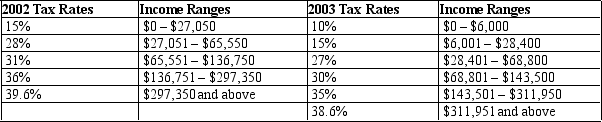

Table 12-12

United States Income Tax Rates for a Single Individual,2002 and 2003.

-Refer to Table 12-12.Samantha is a single person whose taxable income is $100,000 a year.What is her average tax rate in 2002?

-Refer to Table 12-12.Samantha is a single person whose taxable income is $100,000 a year.What is her average tax rate in 2002?

A) 22.3%

B) 25.5%

C) 27.8%

D) 28.4%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Because taxes distort incentives,they typically result in

A) deadweight losses.

B) reductions in consumer surplus.

C) reductions in producer surplus.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the 1980s,President Ronald Reagan argued that high tax rates distorted economic incentives to work and save.In the 1990s,President Bill Clinton argued that the rich were not paying their fair share of taxes.Which of the following statements best summarizes the economic theories behind the differing philosophies?

A) President Reagan was concerned about vertical equity,whereas President Clinton was concerned about horizontal equity.

B) President Reagan was concerned about average tax rates,whereas President Clinton was concerned about horizontal equity.

C) President Reagan was concerned about marginal tax rates,whereas President Clinton was concerned about vertical equity.

D) None of the above is correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 361 - 380 of 397

Related Exams