B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With respect to their impact on aggregate demand for the U.S. economy, which of the following represents the correct ordering of the wealth effect, interest-rate effect, and exchange-rate effect from most important to least important?

A) wealth effect, exchange-rate effect, interest-rate effect

B) exchange-rate effect, interest-rate effect, wealth effect

C) interest-rate effect, wealth effect, exchange-rate effect

D) interest-rate effect, exchange-rate effect, wealth effect

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If the spending multiplier is 8, then the marginal propensity to consume must be 7/8.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

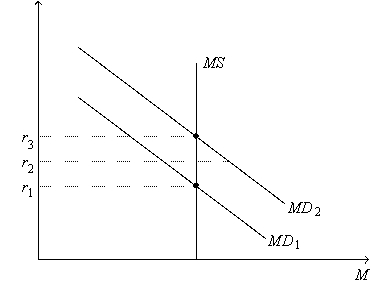

Figure 21-4. On the figure, MS represents money supply and MD represents money demand.  -Refer to Figure 21-4. Suppose the current equilibrium interest rate is r1. Which of the following events would cause the equilibrium interest rate to increase?

-Refer to Figure 21-4. Suppose the current equilibrium interest rate is r1. Which of the following events would cause the equilibrium interest rate to increase?

A) The Federal Reserve increases the money supply.

B) Money demand increases.

C) The price level decreases.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Federal Reserve decided to lower interest rates, it could

A) buy bonds to lower the money supply.

B) buy bonds to raise the money supply.

C) sell bonds to lower the money supply.

D) sell bonds to raise the money supply.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

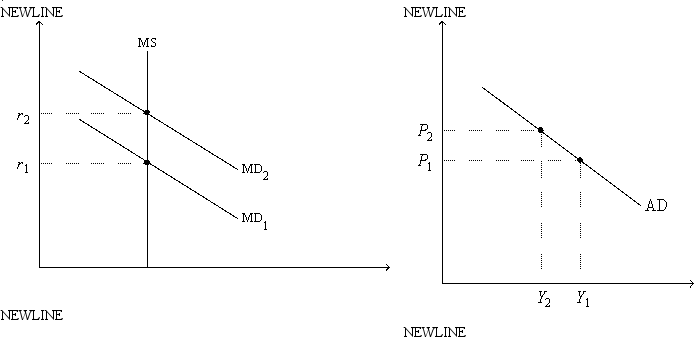

Figure 21-2. On the left-hand graph, MS represents the supply of money and MD represents the demand for money; on the right-hand graph, AD represents aggregate demand. The usual quantities are measured along the axes of both graphs.  -Refer to Figure 21-2. Assume the money market is always in equilibrium. Under the assumptions of the model,

-Refer to Figure 21-2. Assume the money market is always in equilibrium. Under the assumptions of the model,

A) the quantity of goods and services demanded is higher at P2 than it is at P1.

B) the quantity of money is higher at Y1 than it is at Y2.

C) an increase in r from r1 to r2 is associated with a decrease in Y from Y1 to Y2.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to liquidity preference theory, if the quantity of money supplied is greater than the quantity demanded, then the interest rate will

A) increase and the quantity of money demanded will decrease.

B) increase and the quantity of money demanded will increase.

C) decrease and the quantity of money demanded will decrease.

D) decrease and the quantity of money demanded will increase.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

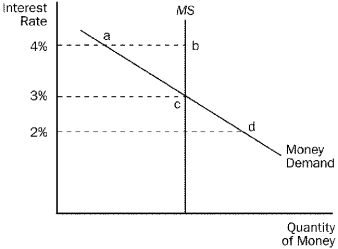

Figure 21-1  -Refer to Figure 21-1. If the current interest rate is 2 percent,

-Refer to Figure 21-1. If the current interest rate is 2 percent,

A) there is an excess supply of money.

B) people will sell more bonds, which drives interest rates up.

C) as the money market moves to equilibrium, people will buy more goods.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the inflation rate is zero, then

A) both the nominal interest rate and the real interest rate can fall below zero.

B) the nominal interest rate can fall below zero, but the real interest rate cannot fall below zero.

C) the real interest rate can fall below zero, but the nominal interest rate cannot fall below zero.

D) neither the nominal interest rate nor the real interest rate can fall below zero.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the MPC is 0.75 and there are no crowding-out or accelerator effects, then an initial increase in aggregate demand of $100 billion will eventually shift the aggregate demand curve to the right by

A) $80 billion.

B) $125 billion.

C) $400 billion.

D) $500 billion.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming a multiplier effect, but no crowding-out or investment-accelerator effects, a $100 billion increase in government expenditures shifts aggregate

A) demand rightward by more than $100 billion.

B) demand rightward by less than $100 billion.

C) supply leftward by more than $100 billion.

D) supply leftward by less than $100 billion.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Critics of stabilization policy argue that

A) policy affects aggregate demand quickly, but the effects on aggregate demand are long-lived.

B) policy affects aggregate demand with a lag, and the effects on aggregate demand are long-lived.

C) policy affects aggregate demand with a lag, but the effects are short-lived.

D) policy does not affect aggregate demand.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed conducts open-market sales, the money supply

A) increases and aggregate demand shifts right.

B) increases and aggregate demand shifts left.

C) decreases and aggregate demand shifts right.

D) decreases and aggregate demand shifts left.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Keynes argued that

A) irrational waves of pessimism cause decreases in aggregate demand and increases in unemployment.

B) irrational waves of optimism cause decreases in aggregate demand and decreases in aggregate supply.

C) changes in business and consumer expectations generally stabilize the economy.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A reduction in U.S net exports would shift U.S. aggregate demand

A) rightward. In an attempt to stabilize the economy, the government could raise taxes.

B) rightward. In an attempt to stabilize the economy, the government could cut taxes.

C) leftward. In an attempt to stabilize the economy, the government could raise taxes.

D) leftward. In an attempt to stabilize the economy, the government could cut taxes.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Both liquidity preference theory and classical theory assume the interest rate adjusts to bring the money market into equilibrium.

B) Both liquidity preference theory and classical theory assume the price level adjusts to bring the money market into equilibrium.

C) Liquidity preference theory assumes the interest rate adjusts to bring the money market into equilibrium; classical theory assumes the price level adjusts to bring the money market into equilibrium.

D) Liquidity preference theory assumes the price level adjusts to bring the money market into equilibrium; classical theory assumes the interest rate adjusts to bring the money market into equilibrium.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 401 - 416 of 416

Related Exams