A) there will be an increase in the equilibrium quantity of goods and services demanded.

B) there will be a decrease in the equilibrium interest rate.

C) the aggregate-demand curve will shift to the right.

D) fewer firms will choose to borrow to build new factories and buy new equipment.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 21-2. The following facts apply to a small, imaginary economy.• Consumption spending is $5,200 when income is $8,000.• Consumption spending is $5,536 when income is $8,400. -Refer to Scenario 21-2. In response to which of the following events could aggregate demand increase by $1,500?

A) A stock-market boom increases households' wealth by $300, and there is an operative crowding-out effect.

B) A stock-market boom increases households' wealth by $275, and there is an operative crowding-out effect.

C) An economic boom overseas increases the demand for U.S. net exports by $240, and there is no crowding-out effect.

D) Aggregate demand could increase by $1,500 in response to any of these events.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to classical macroeconomic theory,

A) the price level is sticky in the short run and it plays only a minor role in the short-run adjustment process.

B) for any given level of output, the interest rate adjusts to balance the supply of, and demand for, money.

C) output is determined by the supplies of capital and labor and the available production technology.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that there is no accelerator affect. The MPC = 3/4. The government increases both expenditures and taxes by $600. The effect of taxes on aggregate demand is 3/4 the size of that created by government expenditures alone. The crowding out effect is 1/5 as strong as the combined effect of government expenditures and taxes on aggregate demand. How much does aggregate demand shift by?

A) $1480

B) $480

C) $160

D) None of the above is correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Permanent tax cuts shift the AD curve

A) farther to the right than do temporary tax cuts.

B) not as far to the right as do temporary tax cuts.

C) farther to the left than do temporary tax cuts.

D) not as far to the left as do temporary tax cuts.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the theory of liquidity preference, a decrease in the price level causes the

A) interest rate and investment to rise.

B) interest rate and investment to fall.

C) interest rate to rise and investment to fall.

D) interest rate to fall and investment to rise.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the money market is initially in equilibrium. If the price level increases, then according to liquidity preference theory there is an excess

A) supply of money until the interest rate increases.

B) supply of money until the interest rate decreases.

C) demand for money until the interest rate increases.

D) demand for money until the interest rate decreases.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shifts in the aggregate-demand curve can cause fluctuations in

A) neither the level of output nor the level of prices.

B) the level of output, but not in the level of prices.

C) the level of prices, but not in the level of output.

D) the level of output and in the level of prices.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009 President Obama and Congress increased government spending. Some economists thought this increase would have little effect on output. Which of the following would make the effect of an increase in government expenditures on aggregate demand smaller?

A) the interest rate falls and aggregate supply is relatively flat

B) the interest rate falls and aggregate supply is relatively steep

C) the interest rate rises and aggregate supply is relatively flat

D) the interest rate rises and aggregate supply is relatively steep

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

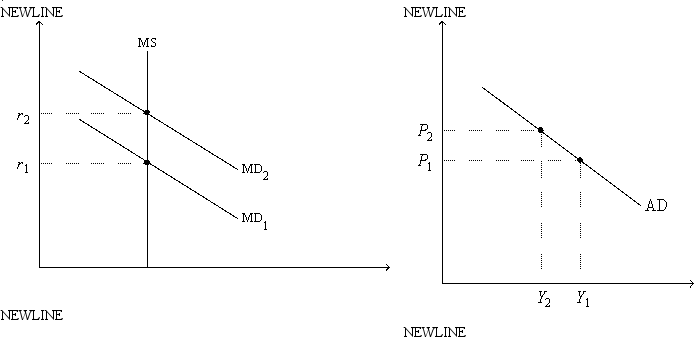

Figure 21-2. On the left-hand graph, MS represents the supply of money and MD represents the demand for money; on the right-hand graph, AD represents aggregate demand. The usual quantities are measured along the axes of both graphs.  -Refer to Figure 21-2. Assume the money market is always in equilibrium, and suppose r1 = 0.08; r2 = 0.12; Y1 = 13,000; Y2 = 10,000; P1 = 1.0; and P2 = 1.2. Which of the following statements is correct? When P = P2,

-Refer to Figure 21-2. Assume the money market is always in equilibrium, and suppose r1 = 0.08; r2 = 0.12; Y1 = 13,000; Y2 = 10,000; P1 = 1.0; and P2 = 1.2. Which of the following statements is correct? When P = P2,

A) investment is lower than it is when P = P1.

B) nominal output is higher than it is when P = P1.

C) the expected rate of inflation is higher than it is when P = P1.

D) the velocity of money is higher than it is when P = P1.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

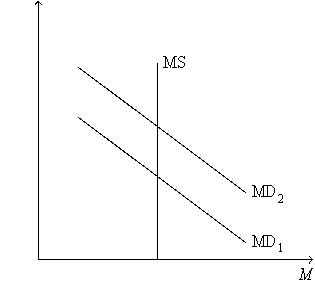

Figure 21-5. On the figure, MS represents money supply and MD represents money demand.  -Refer to Figure 21-5. A shift of the money-demand curve from MD2 to MD1 is consistent with which of the following sets of events?

-Refer to Figure 21-5. A shift of the money-demand curve from MD2 to MD1 is consistent with which of the following sets of events?

A) The government cuts taxes, resulting in an increase in people's incomes.

B) The government reduces government spending, resulting in a decrease in people's incomes.

C) The Federal Reserve increases the supply of money, which decreases the interest rate.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marcus is of the opinion that the theory of liquidity preference explains the determination of the interest rate very well. Most economists would say that Marcus's opinion is

A) Keynesian in nature, and that his view is more valid for the long run than for the short run.

B) classical in nature, and that his view is more valid for the long run than for the short run.

C) Keynesian in nature, and that his view is more valid for the short run than for the long run.

D) classical in nature, and that his view is more valid for the short run than for the long run.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of the following cases does the aggregate-demand curve shift to the right?

A) The price level rises, causing the interest rate to fall.

B) The price level falls, causing the interest rate to fall.

C) The money supply increases, causing the interest rate to fall.

D) The money supply decreases, causing the interest rate to fall.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following raises the interest rate?

A) an increase in government expenditures and an increase in the money supply

B) an increase in government expenditures and a decrease in the money supply

C) a decrease in government expenditures and an increase in the money supply

D) a decrease in government expenditures and a decrease in the money supply

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In liquidity preference theory, an increase in the interest rate, other things the same, decreases the quantity of money demanded, but does not shift the money demand curve.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 21-1. Take the following information as given for a small, imaginary economy: - When income is , consingtion spending is - Whan income is , cansumption spending is -Refer to Scenario 21-1. The multiplier for this economy is

A) 2.86.

B) 2.98.

C) 4.00.

D) 5.00.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What actions could be taken to stabilize output in response to a large decrease in U.S. net exports?

A) increase government expenditures or increase the money supply

B) increase government expenditures or decrease the money supply

C) decrease government expenditures or increase the money supply

D) decrease government expenditures or decrease the money supply

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which among the following assets is the most liquid?

A) corporate bonds

B) fine art

C) deposits that can be withdrawn using ATMs

D) shares of stock

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

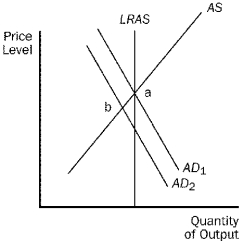

For the following questions, use the diagram below:

Figure 21-7.  -Refer to Figure 21-7. If the economy is at point b, a policy to restore full employment would be

-Refer to Figure 21-7. If the economy is at point b, a policy to restore full employment would be

A) an increase in the money supply.

B) a decrease in government purchases.

C) an increase in taxes.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Sometimes, changes in monetary policy and/or fiscal policy are intended to offset changes to aggregate demand over which policymakers have little or no control.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 416

Related Exams