A) quantity theory of money.

B) price-index theory of money.

C) theory of hyperinflation.

D) disequilibrium theory of money and inflation.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When the value of money is on the vertical axis, an increase in the price level shifts money demand to the right.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same, an increase in velocity means that

A) the rate at which money changes hands falls, so the price level rises.

B) the rate at which money changes hands falls, so the price level falls.

C) the rate at which money changes hands rises, so the price level rises.

D) the rate at which money changes hands rises, so the price level falls.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wealth is redistributed from debtors to creditors when inflation is

A) high, whether it is expected or not.

B) low, whether it is expected or not.

C) unexpectedly high.

D) unexpectedly low.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the price level falls, the number of dollars needed to buy a representative basket of goods

A) increases, so the value of money rises.

B) increases, so the value of money falls.

C) decreases, so the value of money rises.

D) decreases, so the value of money falls.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose one year ago the price index was 120 and Maria purchased $20,000 worth of bonds. One year later the price index is 126. Maria redeems his bonds for $22,250 and is in a 40 percent tax bracket. What is Maria's real after-tax rate of interest to the nearest tenth of a percent?

A) 4.3 percent

B) 3.1 percent

C) 1.8 percent

D) 1.2 percent

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the quantity equation, the price level would change less than proportionately with a rise in the money supply if there were also

A) either a rise in output or a rise in velocity.

B) either a rise in output or a fall in velocity.

C) either a fall in output or a rise in velocity.

D) either a fall in output or a fall in velocity.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

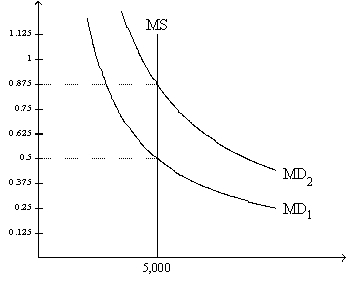

Figure 17-2. On the graph, MS represents the money supply and MD represents money demand. The usual quantities are measured along the axes.  -Refer to Figure 17-2. Suppose the relevant money-demand curve is the one labeled MD1; also suppose the velocity of money is 3. If the money market is in equilibrium, then the economy's real GDP amounts to

-Refer to Figure 17-2. Suppose the relevant money-demand curve is the one labeled MD1; also suppose the velocity of money is 3. If the money market is in equilibrium, then the economy's real GDP amounts to

A) 5,000.

B) 7,500.

C) 10,000.

D) 15,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In the 1990s, U.S. prices rose at about the same rate as in the 1970s.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If money is neutral and velocity is stable, an increase in the money supply creates a proportional increase in

A) real output only.

B) nominal output only.

C) the price level only.

D) both the price level and nominal output.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct? Inflation

A) impedes financial markets in their role of allocating resources.

B) reduces the purchasing power of the average consumer.

C) generally increases after-tax real interest rates.

D) is most costly when anticipated.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that monetary neutrality and the Fisher effect both hold. An increase in the money supply growth rate increases

A) the inflation rate and nominal interest rates.

B) the inflation rate, but not nominal interest rates.

C) nominal interest rates, but not the inflation rate.

D) neither the inflation rate nor nominal interest rates.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If the Fed were to unexpectedly increase the money supply, creditors would gain at the expense of debtors.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An excess supply of money is eliminated by a decrease in the value of money.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Monetary neutrality implies that an increase in the quantity of money will

A) increase employment.

B) increase the price level.

C) increase the incentive to save.

D) not increase any of the above.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inflation can be measured by the

A) change in the consumer price index.

B) percentage change in the consumer price index.

C) percentage change in the price of a specific commodity.

D) change in the price of a specific commodity.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the money market is drawn with the value of money on the vertical axis, as the price level decreases the quantity of money

A) demanded increases.

B) demanded decreases.

C) supplied increases.

D) supplied decreases.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You put money into an account and earn a real interest rate of 6 percent. Inflation is 2 percent, and your marginal tax rate is 20 percent. What is your after-tax real rate of interest?

A) 4.8 percent

B) 3.2 percent

C) 2.8 percent

D) None of the above is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the money market, drawn with the value of money on the vertical axis, is in equilibrium. If the money supply increases, then at the old value of money there is an

A) excess demand for money that will result in an increase in spending.

B) excess demand for money that will result in a decrease in spending.

C) excess supply of money that will result in an increase in spending.

D) excess supply of money that will result in a decrease in spending.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If inflation is higher than what was expected,

A) creditors receive a lower real interest rate than they had anticipated.

B) creditors pay a lower real interest rate than they had anticipated.

C) debtors receive a higher real interest rate than they had anticipated.

D) debtors pay a higher real interest rate than they had anticipated.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 388

Related Exams