A) prevent the attainment of equilibrium in the markets in which they are imposed.

B) make higher taxes necessary.

C) are always unfair to those with low incomes.

D) cause unemployment.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The tax incidence depends on whether the tax is levied on buyers or sellers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Taxes levied on sellers and taxes levied on buyers are equivalent.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

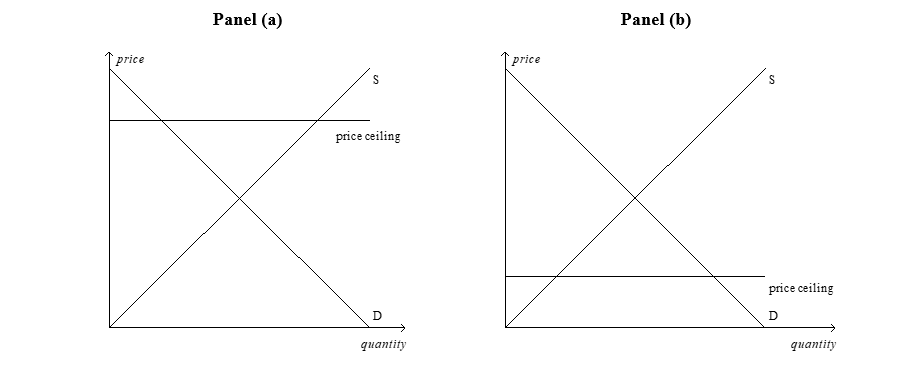

Figure 6-1

-Refer to Figure 6-1. In which panel(s) of the figure would there be a shortage of the good at the price ceiling?

-Refer to Figure 6-1. In which panel(s) of the figure would there be a shortage of the good at the price ceiling?

A) panel (a) only

B) panel (b) only

C) both panel (a) and panel (b)

D) neither panel (a) nor panel (b)

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

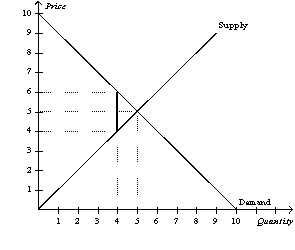

Figure 6-27  -Refer to Figure 6-27. If the government places a $2 tax in the market, the buyer pays $4.

-Refer to Figure 6-27. If the government places a $2 tax in the market, the buyer pays $4.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a binding price floor is imposed on a market for a good, some people who want to sell the good cannot do so.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

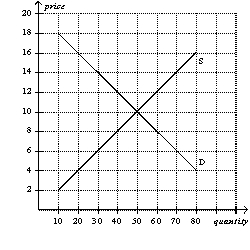

Figure 6-6  -Refer to Figure 6-6. If the government imposes a price ceiling of $12 on this market, then there will be

-Refer to Figure 6-6. If the government imposes a price ceiling of $12 on this market, then there will be

A) no shortage.

B) a shortage of 10 units.

C) a shortage of 20 units.

D) a shortage of 40 units.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tax incidence

A) depends on the legislated burden.

B) is entirely random.

C) depends on the elasticities of supply and demand.

D) falls entirely on buyers or entirely on sellers.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government removes a tax on a good, then the price paid by buyers will

A) increase, and the price received by sellers will increase.

B) increase, and the price received by sellers will decrease.

C) decrease, and the price received by sellers will increase.

D) decrease, and the price received by sellers will decrease.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A minimum wage that is set below a market's equilibrium wage will result in an excess

A) demand for labor, that is, unemployment.

B) demand for labor, that is, a shortage of workers.

C) supply of labor, that is, unemployment.

D) None of the above is correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The minimum wage, if it is binding, raises the incomes of

A) no workers.

B) only those workers who cannot find jobs.

C) only those workers whose jobs would pay less than the minimum wage if it didn't exist.

D) all workers.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

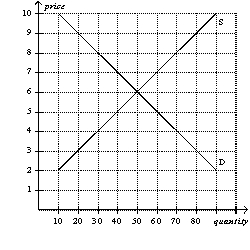

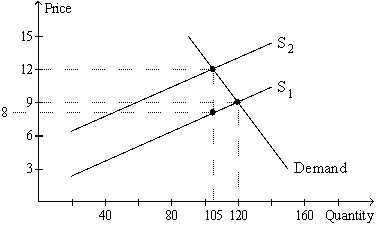

Figure 6-7  -Refer to Figure 6-7. Which of the following price controls would cause a surplus of 20 units of the good?

-Refer to Figure 6-7. Which of the following price controls would cause a surplus of 20 units of the good?

A) a price ceiling set at $4

B) a price ceiling set at $5

C) a price floor set at $7

D) a price floor set at $8

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the sellers of coffee will increase the price of coffee paid by buyers,

A) increase the effective price of coffee received by sellers, and increase the equilibrium quantity of coffee.

B) increase the effective price of coffee received by sellers, and decrease the equilibrium quantity of coffee.

C) decrease the effective price of coffee received by sellers, and increase the equilibrium quantity of coffee.

D) decrease the effective price of coffee received by sellers, and decrease the equilibrium quantity of coffee.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government wants to encourage Americans to exercise more, so it imposes a binding price ceiling on the market for in-home treadmills. As a result,

A) the demand for treadmills will increase.

B) the supply of treadmills will decrease.

C) a shortage of treadmills will develop.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-17  -Refer to Figure 6-17. Suppose buyers, rather than sellers, were required to pay this tax (in the same amount per unit as shown in the graph) . Relative to the tax on sellers, the tax on buyers would result in

-Refer to Figure 6-17. Suppose buyers, rather than sellers, were required to pay this tax (in the same amount per unit as shown in the graph) . Relative to the tax on sellers, the tax on buyers would result in

A) buyers bearing a larger share of the tax burden.

B) sellers bearing a smaller share of the tax burden.

C) the same amount of tax revenue for the government.

D) Both a) and b) are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal Insurance Contribution Act (FICA) tax is an example of a(n)

A) payroll tax.

B) sales tax.

C) farm subsidy.

D) income subsidy.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 541 - 556 of 556

Related Exams