A) consumer surplus shrinks by $50 and tax revenues increase by $30, so there is a deadweight loss of $20.

B) consumer surplus shrinks by $35 and tax revenues increase by $30, so there is a deadweight loss of $5.

C) consumer surplus shrinks by $20 and tax revenues increase by $20, so there is no deadweight loss.

D) consumer surplus shrinks by $15 and tax revenues increase by $20, so there is no deadweight loss.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Zoe,Chloe,and Brody each like to read novels.The current mystery thriller costs $10.Zoe values it at $15,Chloe at $13,and Brody at $11.Suppose that if the government taxes books at 50 cents each the selling price rises to $10.50.A consequence of the tax is that

A) consumer surplus shrinks by $1.50 and tax revenues increase by $1.50, so there is no deadweight loss.

B) consumer surplus shrinks by $9.00 and tax revenues increase by $1.50, so there is a deadweight loss of $7.50.

C) consumer surplus shrinks by $7.50 and tax revenues increase by $7.50, so there is no deadweight loss.

D) consumer surplus shrinks by $7.50 and tax revenues increase by $1.50, so there is a deadweight loss of $6.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

An excise tax is a tax on a specific good,like gasoline.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Many economists believe that

A) the corporate income tax satisfies the goal of horizontal equity.

B) the corporate income tax does not distort the incentives of customers.

C) the corporate income tax is more efficient than the personal income tax.

D) workers and customers bear much of the burden of the corporate income tax.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

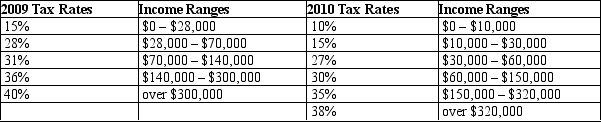

Table 12-12

United States Income Tax Rates for a Single Individual, 2009 and 2010.

-Refer to Table 12-12.Kurt is a single person whose taxable income is $35,000 a year.What is his average tax rate in 2010?

-Refer to Table 12-12.Kurt is a single person whose taxable income is $35,000 a year.What is his average tax rate in 2010?

A) 15.3%

B) 17.6%

C) 21.3%

D) 24.8%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that in 2020 the average citizen's federal tax bill is $9,372,and total federal spending is $10,824 per person.In 2020,the federal government will have

A) a budget surplus.

B) a budget deficit.

C) horizontal equity.

D) vertical equity.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-10

The following table shows the marginal tax rates for unmarried individuals for two years.

-Refer to Table 12-10.Suppose one goal of the tax system was to achieve vertical equity.While people may disagree about what is "equitable," based on the marginal tax rates given for the two years,which of the following statements is true?

-Refer to Table 12-10.Suppose one goal of the tax system was to achieve vertical equity.While people may disagree about what is "equitable," based on the marginal tax rates given for the two years,which of the following statements is true?

A) Vertical equity is possible in both years.

B) Vertical equity is possible in 2009 but not in 2010.

C) Vertical equity is not possible in 2009 but is possible in 2010.

D) Vertical equity is not possible in either year.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Income taxes and property taxes generate the highest tax revenue for state and local governments.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Medicaid is

A) the government's health plan for the elderly.

B) the government's health plan for the poor.

C) another name for Social Security.

D) Both a and c are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

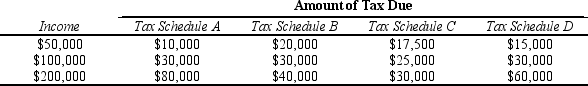

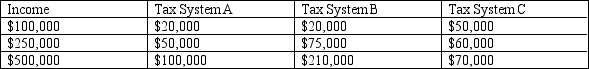

Table 12-11

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-Refer to Table 12-11.For an individual with $200,000 in taxable income,which tax schedule has the highest average tax rate?

-Refer to Table 12-11.For an individual with $200,000 in taxable income,which tax schedule has the highest average tax rate?

A) Tax Schedule A

B) Tax Schedule B

C) Tax Schedule C

D) Tax Schedule D

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government imposes a tax of $3,000 on everyone,the tax would be

A) an income tax.

B) a consumption tax.

C) a lump-sum tax.

D) a marginal tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

By law,all states must have a state income tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lump-sum taxes are rarely used in the real world because

A) while lump-sum taxes have low administrative burdens, they have high deadweight losses.

B) while lump-sum taxes have low deadweight losses, they have high administrative burdens.

C) lump-sum taxes are often viewed as unfair because they take the same amount of money from both poor and rich.

D) lump-sum taxes are very inefficient.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

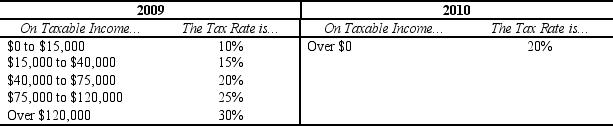

Table 12-6

-Refer to Table 12-6.What is the marginal tax rate for a person who makes $130,000?

-Refer to Table 12-6.What is the marginal tax rate for a person who makes $130,000?

A) 30%

B) 40%

C) 50%

D) 60%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S.federal government finances budget deficits by

A) selling stock, much like a corporation.

B) printing additional currency.

C) borrowing from the public.

D) raising property taxes.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

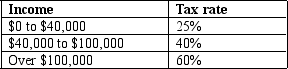

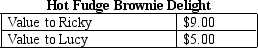

Table 12-4

-Refer to Table 12-4.Suppose that the government imposes a $2 tax on delights,causing the price to increase from $4.00 to $6.00.Total consumer surplus will fall from

-Refer to Table 12-4.Suppose that the government imposes a $2 tax on delights,causing the price to increase from $4.00 to $6.00.Total consumer surplus will fall from

A) $6 to $3.

B) $7 to $4.

C) $6 to $2.

D) $5 to $3.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-17

The dollar amounts in the last three columns are the taxes owed under the three different tax systems.

-Refer to Table 12-17.Which of the three tax systems exhibits vertical equity?

-Refer to Table 12-17.Which of the three tax systems exhibits vertical equity?

A) Tax System A

B) Tax System B

C) Tax System C

D) All of the systems exhibit vertical equity.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Costas faces a progressive federal income tax structure that has the following marginal tax rates: 0 percent on the first $10,000,10 percent on the next $10,000,15 percent on the next $10,000,25 percent on the next $10,000,and 50 percent on all additional income.In addition,he must pay 5 percent of his income in state income tax and 15.3 percent of his labor income in federal payroll taxes.Costas earns $70,000 per year in salary and another $20,000 per year in non-labor income.What is his average tax rate,and what is his marginal tax rate on his salary?

A) His average tax rate is 17.19 percent, and the marginal tax rate on his salary is 55 percent.

B) His average tax rate is 50.23 percent, and the marginal tax rate on his salary is 70.3 percent.

C) His average tax rate is 53.63 percent, and the marginal tax rate on his salary is 70.3 percent.

D) His average tax rate is 55.79 percent, and the marginal tax rate on his salary is 70.3 percent.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is justified on the basis that the taxpayers who pay the tax receive specific government services from payment of the tax,the tax

A) is considered horizontally equitable.

B) burden is minimized.

C) satisfies the benefits principle.

D) is considered vertically equitable.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Most economists believe that a corporate income tax affects the stockholders of a corporation but not its employees or customers.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 301 - 320 of 478

Related Exams