B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The theory that the wealthy should contribute more to police protection than the poor because they have more to protect is based on

A) the ability-to-pay principle.

B) a consumption tax plan.

C) the benefits principle.

D) property tax assessments.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Like spending on Social Security,the share of federal government spending on Medicare has risen substantially over time.This is most likely a result of

A) a rising population of poor in the economy.

B) the elderly population growing more rapidly than the overall population.

C) an immigration policy that promotes an influx of migrant farm workers.

D) All of the above are important factors.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The principle that people should pay taxes based on the benefits they receive from government services is called the

A) pay principle.

B) tax-benefit principle.

C) government services principle.

D) benefits principle.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of the following tax systems do taxes increase as income increases?

A) both proportional and progressive

B) proportional but not progressive

C) progressive but not proportional

D) neither proportional nor progressive

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Many economists believe that the U.S.tax system would be made more efficient if the basis of taxation were changed so that people paid taxes,more so than they do now,based on

A) their saving rather than their income.

B) their spending rather than their income.

C) their income rather than their wealth.

D) their wealth rather than their spending.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

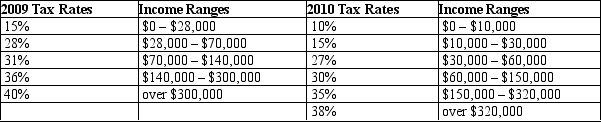

Table 12-12

United States Income Tax Rates for a Single Individual, 2009 and 2010.

-Refer to Table 12-12.Kurt is a single person whose taxable income is $35,000 a year.What is his marginal tax rate in 2010?

-Refer to Table 12-12.Kurt is a single person whose taxable income is $35,000 a year.What is his marginal tax rate in 2010?

A) 10%

B) 15%

C) 27%

D) 30%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

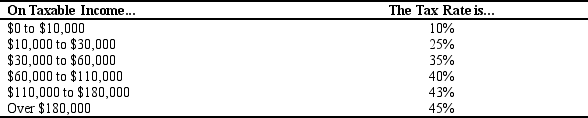

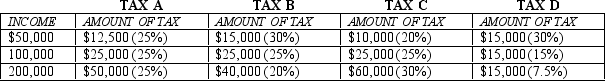

Table 12-9

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.

-Refer to Table 12-9.For this tax schedule,what is the total income tax due for an individual with $49,000 in taxable income?

-Refer to Table 12-9.For this tax schedule,what is the total income tax due for an individual with $49,000 in taxable income?

A) $12,650

B) $14,370

C) $15,960

D) $16,220

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

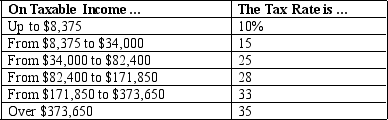

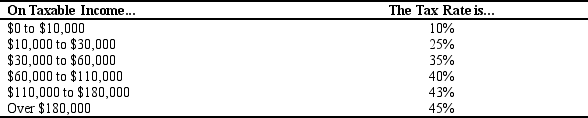

Table 12-1

-Refer to Table 12-1.If Agatha has $80,000 in taxable income,her tax liability is

-Refer to Table 12-1.If Agatha has $80,000 in taxable income,her tax liability is

A) $11,581.

B) $16,181.

C) $20,000.

D) $24,881.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

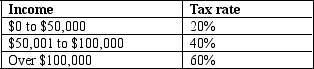

Table 12-7

-Refer to Table 12-7.What is the average tax rate for a person who makes $120,000?

-Refer to Table 12-7.What is the average tax rate for a person who makes $120,000?

A) 25%

B) 35%

C) 45%

D) 60%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-14

-Refer to Table 12-14.A lump-sum tax is illustrated by tax

-Refer to Table 12-14.A lump-sum tax is illustrated by tax

A) A.

B) B.

C) C.

D) D.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on all forms of income will

A) lower the effective rate of interest on savings.

B) have no effect on savings.

C) enhance social welfare because the benefits will outweigh the costs.

D) enhance the incentives to save.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-9

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.

-Refer to Table 12-9.For this tax schedule,what is the average tax rate for an individual with $280,000 in taxable income?

-Refer to Table 12-9.For this tax schedule,what is the average tax rate for an individual with $280,000 in taxable income?

A) 39.9%

B) 40.2%

C) 42.7%

D) 44.8%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pat calculates that for every extra dollar she earns,she owes the government 40 cents.Her total income now is $44,000,on which she pays taxes of $11,000.Determine her average tax rate and her marginal tax rate.

A) Her average tax rate is 40 percent and her marginal tax rate is 25 percent.

B) Her average tax rate is 40 percent and her marginal tax rate is 40 percent.

C) Her average tax rate is 25 percent and her marginal tax rate is 25 percent.

D) Her average tax rate is 25 percent and her marginal tax rate is 40 percent.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Individual income taxes and social insurance taxes generate the highest tax revenue for the federal government.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following contributes to the projected rise in government spending on Social Security and Medicare as a percentage of GDP?

A) increasing life expectancies

B) increasing health care costs

C) increasing fertility rates

D) Both a and b are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

James earns income of $90,000 per year.His average tax rate is 40%.James paid $5,500 in taxes on the first $40,000 he earned.What was the marginal tax rate on the rest of his income?

A) 6.1 percent

B) 44 percent

C) 55 percent

D) 61 percent

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The average American pays a higher percent of his income in taxes today than he would have in the late 18th century.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a tax of 10 percent on the first $40,000 of income and 20 percent on all income above $40,000.What is the average tax rate when income is $50,000?

A) 20 percent

B) 15 percent

C) 12 percent

D) 10 percent

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax takes a smaller fraction of income as income rises,it is

A) proportional.

B) regressive.

C) progressive.

D) based on the ability-to-pay principle.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 261 - 280 of 478

Related Exams