A) For each unit of the good that is sold, buyers bear one-half of the tax burden, and sellers bear one-half of the tax burden.

B) For each unit of the good that is sold, buyers bear one-third of the tax burden, and sellers bear two-thirds of the tax burden.

C) For each unit of the good that is sold, buyers bear one-fourth of the tax burden, and sellers bear three-fourths of the tax burden.

D) For each unit of the good that is sold, buyers bear three-fourths of the tax burden, and sellers bear one-fourth of the tax burden.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the market for widgets,the supply curve is the typical upward-sloping straight line,and the demand curve is the typical downward-sloping straight line.The equilibrium quantity in the market for widgets is 200 per month when there is no tax.Then a tax of $5 per widget is imposed.As a result,the government is able to raise $750 per month in tax revenue.We can conclude that the equilibrium quantity of widgets has fallen by

A) 25 per month.

B) 50 per month.

C) 75 per month.

D) 100 per month.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax shifts the demand curve upward (or to the right) ,we can infer that the tax was levied on

A) buyers of the good.

B) sellers of the good.

C) both buyers and sellers of the good.

D) We cannot infer anything because the shift described is not consistent with a tax.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a tax of $5 per unit is imposed on a good.The supply curve is a typical upward-sloping straight line,and the demand curve is a typical downward-sloping straight line.The tax decreases consumer surplus by $10,000 and decreases producer surplus by $15,000.The deadweight loss of the tax is $2,500.The tax decreased the equilibrium quantity of the good from

A) 6,500 to 5,500.

B) 5,500 to 4,500.

C) 5,000 to 3,000.

D) 6,000 to 4,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When a tax is imposed on sellers,producer surplus decreases but consumer surplus increases.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

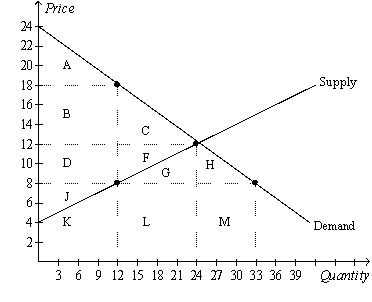

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.

-Refer to Figure 8-8.After the tax goes into effect,consumer surplus is the area

-Refer to Figure 8-8.After the tax goes into effect,consumer surplus is the area

A) A.

B) B+C.

C) A+B+C.

D) A+B+D+J+K.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

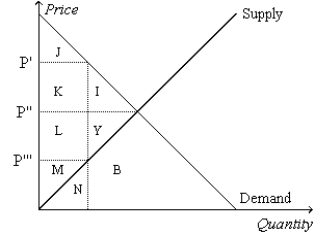

Figure 8-1

-Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The deadweight loss due to the tax is measured by the area

-Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The deadweight loss due to the tax is measured by the area

A) J+K+L+M.

B) J+K+L+M+N.

C) I+Y.

D) I+Y+B.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that policymakers are considering placing a tax on either of two markets.In Market A,the tax will have a significant effect on the price consumers pay,but it will not affect equilibrium quantity very much.In Market B,the same tax will have only a small effect on the price consumers pay,but it will have a large effect on the equilibrium quantity.Other factors are held constant.In which market will the tax have a larger deadweight loss?

A) Market A

B) Market B

C) The deadweight loss will be the same in both markets.

D) There is not enough information to answer the question.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The more inelastic are demand and supply,the greater is the deadweight loss of a tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxes cause deadweight losses because taxes

A) reduce the sum of producer and consumer surpluses by more than the amount of tax revenue.

B) prevent buyers and sellers from realizing some of the gains from trade.

C) cause marginal buyers and marginal sellers to leave the market, causing the quantity sold to fall.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The deadweight loss from a tax of $8 per unit will be smallest in a market with

A) elastic demand and elastic supply.

B) elastic demand and inelastic supply.

C) inelastic demand and elastic supply.

D) inelastic demand and inelastic supply.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider a good to which a per-unit tax applies.The size of the deadweight that results from the tax is smaller,the

A) larger is the price elasticity of demand.

B) smaller is the price elasticity of supply.

C) larger is the amount of the tax.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider a good to which a per-unit tax applies.The size of the deadweight that results from the tax is smaller,the

A) less elastic is the demand for the good.

B) less elastic is the supply of the good.

C) smaller is the amount of the tax.

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax shifts the supply curve upward (or to the left) ,we can infer that the tax was levied on

A) buyers of the good.

B) sellers of the good.

C) both buyers and sellers of the good.

D) We cannot infer anything because the shift described is not consistent with a tax.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax placed on a good

A) causes the effective price to sellers to increase.

B) affects the welfare of buyers of the good but not the welfare of sellers.

C) causes the equilibrium quantity of the good to decrease.

D) creates a burden that is usually borne entirely by the sellers of the good.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The supply curve for cameras is the typical upward-sloping straight line,and the demand curve for cameras is the typical downward-sloping straight line.When cameras are taxed,the area on the relevant supply-and-demand graph that represents

A) government's tax revenue is a rectangle.

B) the deadweight loss of the tax is a triangle.

C) the loss of consumer surplus caused by the tax is neither a rectangle nor a triangle.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 8-1 Erin would be willing to pay as much as $100 per week to have her house cleaned. Ernesto's opportunity cost of cleaning Erin's house is $70 per week. -Refer to Scenario 8-1.If Ernesto cleans Erin's house for $80,Ernesto's producer surplus is

A) $80.

B) $30.

C) $20.

D) $10.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

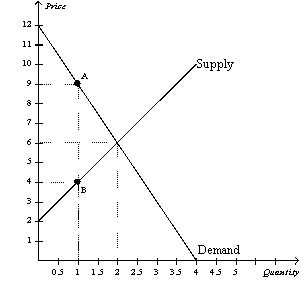

Figure 8-2

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-2.Consumer surplus without the tax is

-Refer to Figure 8-2.Consumer surplus without the tax is

A) $6, and consumer surplus with the tax is $1.50.

B) $6, and consumer surplus with the tax is $4.50.

C) $10, and consumer surplus with the tax is $1.50.

D) $10, and consumer surplus with the tax is $4.50.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

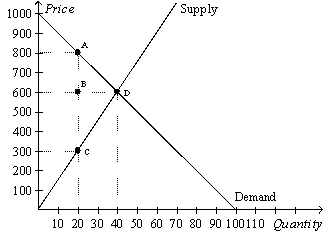

Figure 8-9

The vertical distance between points A and C represent a tax in the market.

-Refer to Figure 8-9.The loss of producer surplus as a result of the tax is

-Refer to Figure 8-9.The loss of producer surplus as a result of the tax is

A) $3,000.

B) $6,000.

C) $9,000.

D) $12,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

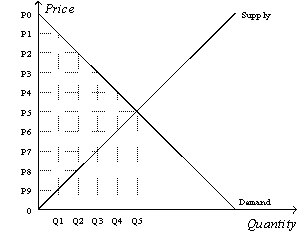

Figure 8-10

-Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.Without the tax,the consumer surplus is

-Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.Without the tax,the consumer surplus is

A) (P0-P2) x Q2.

B) ![]() x (P0-P2) x Q2.

x (P0-P2) x Q2.

C) (P0-P5) x Q5.

D) ![]() x (P0-P5) x Q5.

x (P0-P5) x Q5.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 361 - 380 of 424

Related Exams