A) $2

B) $3

C) $4

D) $5

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

For many industrial countries,import tariffs tend to increase with stages of processing and manufacturing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

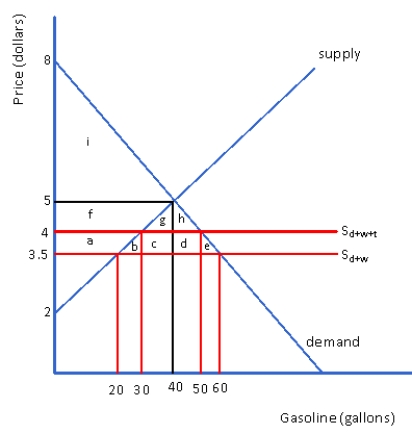

Figure 4.4 Market for Gasoline in a Small Nation

-Figure 4.4 represents the market for gasoline in a small nation.The free trade world price of gasoline is $3.50.Suppose this small nation imposes a tariff on gasoline of $.50 per gallon.The change in consumer surplus would be

-Figure 4.4 represents the market for gasoline in a small nation.The free trade world price of gasoline is $3.50.Suppose this small nation imposes a tariff on gasoline of $.50 per gallon.The change in consumer surplus would be

A) area a + b

B) area a

C) area a + b + c + d + e

D) area a + b + f + g + h

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A "large" country,that levies a tariff on imports,cannot improve the terms at which it trades with other countries.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Developing nations often maintain that industrial countries permit raw materials to be imported at very low tariff rates while maintaining high tariff rates on manufactured imports.Which of the following refers to the above statement?

A) Tariff-quota effect

B) Nominal tariff effect

C) Tariff escalation effect

D) Protective tariff effect

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the production of $500,000 worth of steel in the United States requires $100,000 worth of iron ore.The U.S.nominal tariff rates for importing these goods are 15 percent for steel and 5 percent for iron ore.Given this information,the effective rate of protection for the U.S.steel industry is approximately:

A) 6 percent

B) 12 percent

C) 18 percent

D) 24 percent

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Assume that the United States imports VCRs from South Korea at a price of $200 per unit and that these VCRs are subject to an import tariff of 20 percent.Also assume that U.S.components are used in the VCRs assembled by South Korea and that these components have a value of $100.Under the Offshore Assembly Provision of U.S.tariff policy,the price of an imported VCR to the U.S.consumer after the tariff has been levied is $220.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a tariff reduces the quantity of Japanese autos imported by the United States,over time it reduces the ability of Japan to import goods from the United States.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 4.1 illustrates the demand and supply schedules for pocket calculators in Mexico,a "small" nation that is unable to affect the world price.

Figure 4.1.Import Tariff Levied by a "Small" Country

-Consider Figure 4.1.With free trade,Mexico's producer surplus and consumer surplus respectively equal:

-Consider Figure 4.1.With free trade,Mexico's producer surplus and consumer surplus respectively equal:

A) $5,$605

B) $25,$380

C) $45,$250

D) $85,$195

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If a small country levies a tariff on imports,its overall national welfare necessarily falls.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For a "small" country,a tariff raises the domestic price of an imported product by the full amount of the duty.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The revenue that producers receive over and above the minimum necessary for production is called

A) deadweight loss

B) deadweight gain

C) producer surplus

D) consumer surplus

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the world price is $40,a specific tariff of $10 is equivalent to an ad valorem tariff of

A) $10

B) $20

C) 20 percent

D) 25 percent

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A tariff can increase the welfare of a "large" levying country if the favorable terms-of-trade effect more than offsets the unfavorable protective effect and consumption effect.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

There is widespread agreement among economists that import tariffs increase overall employment in the levying country.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

During a business recession,when cheaper products are purchased,a specific tariff provides domestic producers a greater amount of protection against import-competing goods.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the production of a commodity does not utilize imported inputs,the effective tariff rate on the commodity:

A) Exceeds the nominal tariff rate on the commodity

B) Equals the nominal tariff rate on the commodity

C) Is less than the nominal tariff rate on the commodity

D) None of the above

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Concerning U.S.tariff policy,the offshore assembly provision (OAP) provides unfavorable treatment to products assembled abroad from U.S.made components.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

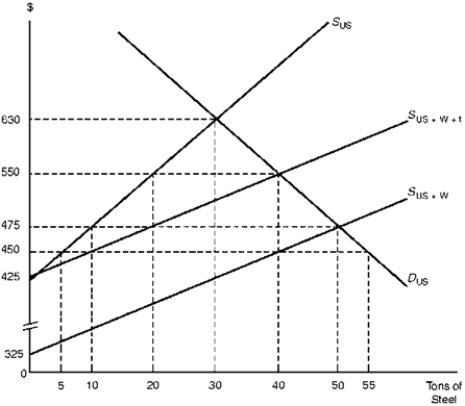

Assume the United States is a large consumer of steel that is able to influence the world price.Its demand and supply schedules are respectively denoted by DU.S.and SU.S.in Figure 4.2.The overall (United States plus world) supply schedule of steel is denoted by SU.S.+W.

Figure 4.2.Import Tariff Levied by a "Large" Country

-According to Figure 4.2,the tariff's terms-of-trade effect equals:

-According to Figure 4.2,the tariff's terms-of-trade effect equals:

A) $300

B) $400

C) $500

D) $600

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A foreign-trade zone (FTZ) is an area within the United States where business can operate without the responsibility of paying customs duties on imported products or materials for as long as they remain within this area and do not enter the U.S.marketplace.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 162

Related Exams