B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of Social Security benefits received by an individual that he or she must include in gross income:

A) Is computed in the same manner as an annuity [exclusion = (cost/expected return) × amount received].

B) May not exceed the portion contributed by the employer.

C) May not exceed 50% of the Social Security benefits received.

D) May be zero or as much as 85% of the Social Security benefits received, depending upon the taxpayer's Social Security benefits and other income.

E) None of these.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Brad, who uses the cash method of accounting, lives in a state that imposes an income tax (including withholding from wages) .On April 14, 2019, he files his state return for 2018, paying an additional $600 in state income taxes.During 2019, his withholdings for state income tax purposes amount to $3,550.On April 13, 2020, he files his state return for 2019 claiming a refund of $800.Brad receives the refund on June 3, 2020.If he itemizes deductions, how much may Brad claim as a deduction for state income taxes on his Federal income tax return for calendar year 2019 (filed in April 2020) ?

A) $3,350

B) $3,550

C) $4,150

D) $5,150

E) None of these

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fred and Lucy are married, ages 33 and 32, and together have AGI of $120,000 in 2019.They have four dependents and file a joint return.They pay $5,000 for a high deductible health insurance policy and contribute $2,600 to a qualified Health Savings Account.During the year, they paid the following amounts for medical care: $9,200 in doctor and dentist bills and hospital expenses, and $3,000 for prescribed medicine and drugs.In October 2019, they received an insurance reimbursement of $4,400 for the hospitalization.They expect to receive an additional reimbursement of $1,000 in January 2020.Determine the maximum itemized deduction allowable for medical expenses in 2019.

A) $800

B) $3,800

C) $9,200

D) $12,800

E) None of these

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

For purposes of computing the deduction for qualified residence interest, a qualified residence includes only the taxpayer's principal residence.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Qualifying tuition expenses paid from the proceeds of a tax-exempt scholarship do not give rise to an education tax credit.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Sam was unemployed for the first two months of 2019.During that time, he received $4,000 of state unemployment benefits.He worked for the next six months and earned $14,000.In September, he was injured on the job and collected $5,000 of workers' compensation benefits.Sam's Federal gross income from this is $18,000 ($4,000 + $14,000).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Herbert is the sole proprietor of a furniture store.He can deduct real property taxes on his store building as a business deduction but he cannot deduct state income taxes related to his net income from the furniture store as a business deduction.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer's earned income credit may be determined by the number of his or her qualifying children.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For purposes of computing the credit for child and dependent care expenses, the qualifying employment-related expenses are limited to an individual's actual or deemed earned income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the terms of a divorce agreement entered into in 2018, Kim was to pay her husband Tom $7,000 per month in alimony.Kim's payments will be reduced to $3,000 per month when their 9 year-old son becomes 21.The husband has custody of their son.For a 12 month period, Kim can deduct from gross income (and Tom must include in gross income) :

A) $60,000.

B) $48,000.

C) $36,000.

D) $0.

E) None of these.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Al contributed a painting to the Metropolitan Art Museum of St.Louis, MO.The painting, purchased six years earlier, was worth $40,000 when donated, and Al's basis was $25,000.If this painting is immediately sold by the museum and the proceeds are placed in the general fund, Al's charitable contribution deduction is $25,000 (subject to percentage limitations).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

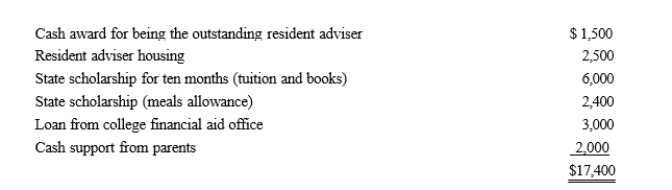

Ron, age 19, is a full-time graduate student at City University.During 2019, he received the following payments:  Ron served as a resident adviser in a dormitory and, therefore, the university waived the $2,500 charge for the room he occupied.What is Ron's adjusted gross income for 2019?

Ron served as a resident adviser in a dormitory and, therefore, the university waived the $2,500 charge for the room he occupied.What is Ron's adjusted gross income for 2019?

A) $1,500.

B) $3,900.

C) $9,000.

D) $15,400.

E) None of these.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Judy paid $40 for Girl Scout cookies and $40 for Boy Scout popcorn.She may claim an $80 charitable contribution deduction.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Maria made significant charitable contributions of capital gain property in the current year.In fact, the amount of the contributions exceeds 30% of her AGI.The excess charitable contribution that is not deductible this year can be carried over for five years.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Leona borrows $100,000 from First National Bank and uses the proceeds to purchase City of Houston bonds.The interest Leona pays on this loan is deductible as investment interest subject to the investment interest limits.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Jack sold a personal residence to Steven and paid points of $3,500 on the loan to help Steven finance the purchase. Jack can deduct the points as interest.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Only married taxpayers with children can claim the earned income credit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

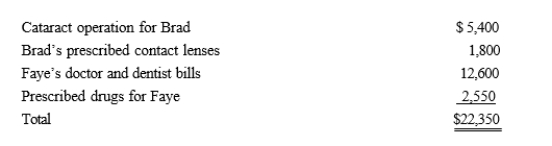

Brad, who would otherwise qualify as Faye's dependent, had gross income of $9,000 during the year.Faye, who had AGI of $120,000, paid the following medical expenses this year:  Faye has a medical expense deduction of:

Faye has a medical expense deduction of:

A) $3,150

B) $4,950

C) $10,350

D) $13,350

E) None of these

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The earned income credit is available only if the taxpayer has at least one qualifying child in the household.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 129

Related Exams