A) Having a sales employee inspect customer's inventory for specific product lines.

B) Using a manufacturer's representative for the taxpayer through a sales office in the state.

C) Executing a sales campaign using an advertising agency acting as an independent contractor for the taxpayer.

D) Maintaining inventory in the state by an independent contractor under a consignment plan.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding foreign persons not engaged in a U.S.trade or business is true?

A) Foreign persons are subject to potential withholding taxes on the gross amount of U.S.-source investment income.

B) Foreign persons with any U.S.-source income are taxed on net investment income (after expenses) .

C) Foreign persons are not subject to U.S.tax if not engaged in a U.S.trade or business.

D) Foreign persons with only U.S.-source investment income are exempt from U.S.tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A unitary business applies a combined apportionment formula, including data from operations of all affiliates.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Section 482 is used by the U.S.Treasury to:

A) Force taxpayers to use arms length transfer pricing on transactions between related parties.

B) Reallocate income, deductions, etc., to a related taxpayer to minimize tax liability.

C) Increase information that is reported about U.S.corporations with non-U.S.owners.

D) All of these.

E) None of these.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

U.S.income tax treaties typically:

A) Provide for taxation exclusively by the source country.

B) Provide for taxation exclusively by the country of residence.

C) Provide rules by which multinational taxpayers avoid double taxation.

D) Provide that the country with the highest tax rate will be allowed exclusive tax collection rights.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding income sourcing is not correct?

A) Concerning the foreign tax credit, most U.S.persons benefit from earning low-tax foreign-source income.

B) Foreign persons generally benefit from avoiding U.S.-source income classification.

C) U.S.persons are not concerned with source of income because all their income is subject to U.S.tax under a worldwide system.

D) Foreign persons may be subject to tax on U.S.-source income without regard to their actual presence in the United States.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A "U.S.shareholder" for purposes of CFC classification is any U.S.person who owns directly, indirectly, and constructively at least 50% of the voting power of a foreign corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Zhao Company sold an asset on the first day of the tax year for $500,000.Zhao's Federal tax basis for the asset was $300,000.Because of differences in cost recovery schedules, the state regular-tax basis in the asset was $350,000.What modification, if any, should be made to Zhao's Federal taxable income in determining the correct taxable income for the typical state?

A) $0

B) ($50,000)

C) $50,000

D) $150,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the taxation of U.S.real property gains recognized by non-U.S.persons not engaged in a U.S.trade or business is false? Gains from the disposition of U.S.real property are:

A) Not taxed to non-U.S.persons because real property gains are specifically exempt from U.S.taxation.

B) Taxed to non-U.S.persons without regard to whether such non-U.S.persons are engaged in a U.S.trade or business.

C) Taxed in the United States because such gains are treated as if they are effectively connected to a U.S.trade or business.

D) Taxed to non-U.S.persons notwithstanding the general exemption of capital gains from U.S.taxation.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Julio, a nonresident alien, realizes a gain on the sale of commercial real estate located in Omaha.The real estate was sold to Mariana, Julio's cousin who is also a nonresident alien.Julio recognizes foreign-source income from the sale because his home country is not the United States.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The model law relating to the assignment of income among the states for corporations is:

A) Public Law 86-272.

B) The Multistate Tax Treaty.

C) The Multistate Tax Commission (MTC) .

D) The Uniform Division of Income for Tax Purposes Act (UDITPA) .

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

OutCo, a controlled foreign corporation in Meena (located outside the United States) , earns $600,000 in net interest and dividend income from investments in the bonds and stock of unrelated companies.All of the dividend payors are located in Meena.OutCo's Subpart F income for the year is:

A) $0.

B) $0 only if OutCo is engaged in a trade or business in Meena.

C) $600,000.

D) $600,000 only if OutCo is engaged in a trade or business in Meena.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under P.L.86-272, which of the following transactions by itself would create nexus with a state?

A) Order solicitation for a plot of real estate approved and filled from another state.

B) Order solicitation for a computer approved and filled from another state.

C) Order solicitation for a machine with credit approval from another state.

D) The conduct of a training seminar for sales personnel as to how to install and operate a new software product.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A typical state taxable income addition modification is for the state's NOL allowed the taxpayer for the tax year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Typical indicators of income tax nexus include the presence of customers in the state.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Typically, sales/use taxes constitute about 20% of a state's annual tax collections for most states.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

By making a water's edge election, a multinational taxpayer can limit the reach of unitary principles to the apportionment factors and income of its U.S.and E.U.affiliates.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Flint Corporation is subject to a corporate income tax only in State X.The starting point in computing X taxable income is Federal taxable income which is $750,000.This amount includes a $50,000 deduction for state income taxes.During the year, Flint received $10,000 interest on Federal obligations.X tax law does not allow a deduction for state income tax payments. Flint's taxable income for X purposes is:

A) $810,000

B) $800,000

C) $790,000

D) $750,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Peanut, Inc., a U.S.corporation, receives $500,000 of foreign-source interest income on which foreign taxes of $5,000 are withheld.Peanut's worldwide taxable income is $900,000, and its U.S.Federal income tax liability before FTC is $189,000.What is Peanut's foreign tax credit?

A) $500,000

B) $189,000

C) $105,000

D) $5,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

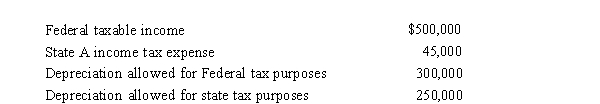

Ramirez Corporation, which is subject to income tax only in State A, generated the following income and deductions:  Federal taxable income is the starting point in computing A taxable income.State income taxes are not deductible for A tax purposes.Ramirez's A taxable income is:

Federal taxable income is the starting point in computing A taxable income.State income taxes are not deductible for A tax purposes.Ramirez's A taxable income is:

A) $495,000

B) $500,000

C) $545,000

D) $595,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 91

Related Exams