B) False

Correct Answer

verified

Correct Answer

verified

True/False

In December 2018, Emily, a cash basis taxpayer, received a $2,500 cash scholarship for the Spring semester of 2019.However, she did not use the funds to pay the tuition until January 2019.Emily can exclude the $2,500 from her gross income in 2018.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer may qualify for the credit for child and dependent care expenses if the taxpayer's dependent is under age 17.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

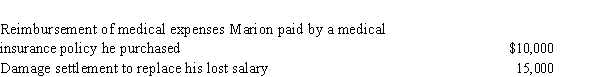

Early in the year, Marion was in an automobile accident during the course of his employment.As a result of the physical injuries he sustained, he received the following payments during the year:  What is the amount that Marion must include in gross income for the current year?

What is the amount that Marion must include in gross income for the current year?

A) $25,000.

B) $15,000.

C) $12,500.

D) $10,000.

E) $0.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Expenses that are reimbursed by a taxpayer's employer under a dependent care assistance program also can qualify for the credit for child and dependent care expenses.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer may not deduct the cost of new curbing relative to a personal residence), even if the construction is required by the city and the curbing provides an incidental benefit to the public welfare.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Interest paid or accrued during 2018 on aggregate acquisition indebtedness of $2 million or less $1 million or less for married persons filing separate returns) is deductible as qualified residence interest.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Trent sells his personal residence to Chester on July 1, 2018.He had paid $7,000 in real property taxes on March 1, 2018, the due date for property taxes for 2018.Trent may not deduct the portion of the taxes he paid for the period the property was owned by Chester.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Matt, a calendar year taxpayer, pays $11,000 in medical expenses in 2018.He expects $5,000 of these expenses to be reimbursed by an insurance company in 2019.In determining his medical expense deduction for 2018, Matt must reduce his 2018 medical expenses by the amount of the reimbursement he expects in 2019.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Betty received a graduate teaching assistantship that was awarded on the basis of academic achievement.The payments must be included in her gross income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Georgia contributed $2,000 to a qualifying Health Savings Account in the current year.The entire amount qualifies as an expense deductible for AGI.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the current year, Khalid was in an automobile accident and suffered physical injuries.The accident was caused by Rashad's negligence.Khalid threatened to file a lawsuit against Amber Trucking Company, Rashad's employer, claiming $50,000 for pain and suffering, $90,000 for loss of income, and $70,000 in punitive damages.Amber's insurance company will not pay punitive damages; therefore, Amber has offered to settle the case for $100,000 for pain and suffering, $90,000 for loss of income, and nothing for punitive damages.Khalid is in the 35% marginal tax bracket.What is the after-tax difference to Khalid between Khalid's original claim and Amber's offer?

A) Amber's offer is $20,000 less.$50,000 + $90,000 + $70,000 - $100,000 - $90,000) .

B) Amber's offer is $7,000 less.[$50,000 + $90,000 + $70,000 - $100,000 - $90,000) × .35) ].

C) Amber's offer is $4,500 more.{$190,000 - $50,000 + $90,000) + [$70,000 × 1 - .35) ]}.

D) Amber's offer is $22,000 more.[$190,000 - $210,000) + $120,000 × .35) ].

E) None of these.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

John told his nephew, Steve, "if you maintain my house when I cannot, I will leave the house to you when I die." Steve maintained the house and when John died Steve inherited the house.The value of the residence can be excluded from Steve's gross income as an inheritance.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

George and Erin divorced in 2019, and George is required to pay Erin $20,000 of alimony each year.George earns $75,000 a year.Erin is required to include the alimony payments in gross income although George earned the income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The exclusion of interest on educational savings bonds:

A) Applies only to savings bonds owned by the child.

B) Applies to parents who purchase bonds for which the proceeds are used for their child's education.

C) Means that the child must include the interest in income if the bond is owned by the parent.

D) Does apply even if used to pay for room and board.

E) None of these.

G) A) and B)

Correct Answer

verified

B

Correct Answer

verified

True/False

Dan contributed stock worth $16,000 to his college alma mater, a qualified charity.He acquired the stock 11 months ago for $4,000.He may deduct $16,000 as a charitable contribution deduction subject to percentage limitations).

B) False

Correct Answer

verified

False

Correct Answer

verified

True/False

If a scholarship does not satisfy the requirements for a gift, the scholarship must be included in gross income.

B) False

Correct Answer

verified

False

Correct Answer

verified

True/False

Agnes receives a $5,000 scholarship which covers her tuition at Parochial High School.She may not exclude the $5,000 because the exclusion applies only to scholarships to attend college.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Ronaldo contributed stock worth $12,000 to the Children's Protective Agency, a qualified charity.He acquired the stock 20 months ago for $7,000.He may deduct $7,000 as a charitable contribution deduction subject to percentage limitations).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

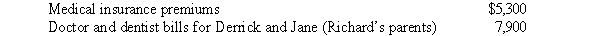

Richard, age 50, is employed as an actuary.For calendar year 2018, he had AGI of $130,000 and paid the following medical expenses:

Derrick and Jane would qualify as Richard's dependents except that they file a joint return.Richard's medical insurance policy does not cover them.Richard filed a claim for $4,800 of his own expenses with his insurance company in November 2018 and received the reimbursement in January 2019.What is Richard's maximum allowable medical expense deduction for 2018?

Derrick and Jane would qualify as Richard's dependents except that they file a joint return.Richard's medical insurance policy does not cover them.Richard filed a claim for $4,800 of his own expenses with his insurance company in November 2018 and received the reimbursement in January 2019.What is Richard's maximum allowable medical expense deduction for 2018?

A) $0

B) $7,090

C) $10,340

D) $20,090

E) None of the above

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 119

Related Exams