A) increase,the real exchange rate of the U.S.dollar appreciates,and U.S.net capital outflow increases.

B) increase,the real exchange rate of the U.S.dollar depreciates,and U.S.net capital outflow is unchanged.

C) decrease,the real exchange rate of the U.S.dollar appreciates,and U.S.net capital outflow is unchanged.

D) decrease,the real exchange rate of the U.S.dollar depreciates,and U.S.net capital outflow decreases.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the most accurate statement?

A) Trade policy has neither microeconomic nor macroeconomic effects.

B) Trade policy has similar microeconomic and macroeconomic effects.

C) The effects of trade policy are more macroeconomic than microeconomic.

D) The effects of trade policy are more microeconomic than macroeconomic.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct in an open economy?

A) S = I

B) S = NX + NCO

C) S = NCO

D) S = I + NCO

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a government increases its budget deficit,then the real exchange rate

A) and domestic investment rise.

B) and domestic investment fall.

C) rises and domestic investment falls.

D) falls and domestic investment rises.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would make the equilibrium real interest rate increase and the equilibrium quantity of funds decrease?

A) The demand for loanable funds shifts right.

B) The demand for loanable funds shifts left.

C) The supply of loanable funds shifts right.

D) The supply of loanable funds shifts left.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If at a given exchange rate foreign citizens wanted to buy fewer U.S bonds,then the

A) supply of dollars in the market for foreign-currency exchange shfits right.

B) supply of dollars in the market for foreign-currency exchange shfits left.

C) demand for dollars in the market for foreign-currency exchange shfits right.

D) demand for dollars in the market for foreign-currency exchange shfits left.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The variable that links the market for loanable funds and the market for foreign-currency exchange is

A) net capital outflow.

B) national saving.

C) exports.

D) domestic investment.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If net exports are positive,then

A) exports are greater than imports.

B) net capital outflow is negative.

C) Both of the above are correct.

D) Neither of the above is correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

What is the source of the demand for dollars in the market for foreign-currency exchange?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same,an increase in the U.S.interest rate causes the quantity of loanable funds supplied to

A) rise because net capital outflow and domestic investment rise.

B) rise because national saving rises.

C) fall because net capital outflow and domestic investment rise.

D) fall because national saving falls.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

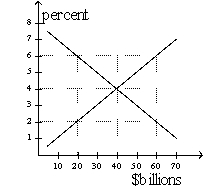

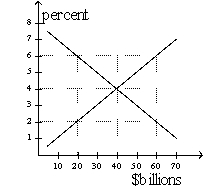

Figure 19-1  -Refer to Figure 19-1.In the Figure shown,if the real interest rate is 6 percent,the quantity of loanable funds demanded is

-Refer to Figure 19-1.In the Figure shown,if the real interest rate is 6 percent,the quantity of loanable funds demanded is

A) $20 billion,and the quantity supplied is $40 billion.

B) $20 billion,and the quantity supplied is $60 billion.

C) $60 billion,and the quantity supplied is $20 billion.

D) $60 billion,and the quantity supplied is $40 billion.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the equilibrium real interest rate in the open-economy macroeconomic model,the equilibrium quantity of loanable funds equals

A) net capital outflow.

B) domestic investment.

C) foreign currency supplied.

D) national saving.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 19-1  -Refer to Figure 19-1.In the Figure shown,if the real interest rate is 6 percent,there will be pressure for

-Refer to Figure 19-1.In the Figure shown,if the real interest rate is 6 percent,there will be pressure for

A) the real interest rate to fall.

B) the demand for loanable funds curve to shift left.

C) the supply for loanable funds curve to shift right.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a country experiences capital flight,which of the following curves shift right?

A) only the demand for loanable funds.

B) only the supply of dollars in the market for foreign-currency exchange.

C) only the net capital outflow curve and the supply of dollars in the market for foreign currency exchange.

D) the demand for loanable funds,the net capital outflow curve,and the supply of dollars in the market for foreign currency exchange.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2002,the United States imposed restrictions on the importation of steel into the United States.The open-economy macroeconomic model shows that such a policy would

A) lower the real exchange rate and increase net exports.

B) lower the real exchange rate and have no effect on net exports.

C) raise the real exchange rate and decrease net exports.

D) raise the real exchange rate and have no effect on net exports.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a country imposes an import quota,its

A) imports fall and its net exports rise.

B) imports fall and its net exports are unchanged.

C) imports rise and its net exports are unchanged.

D) imports and exports are unchanged.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A country has national saving of $80 billion,government expenditures of $40 billion,domestic investment of $60 billion,and net capital outflow of $20 billion.What is its demand for loanable funds?

A) $40 billion

B) $60 billion

C) $80 billion

D) $120 billion

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The open-economy macroeconomic model includes

A) only the market for loanable funds.

B) only the market for foreign-currency exchange.

C) both the market for loanable funds and the market for foreign-currency exchange.

D) neither the market for loanable funds or the market for foreign-currency exchange.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the open-economy macroeconomic model,the supply of loanable funds comes from

A) the sum of domestic investment and net capital outflow.

B) the sum of national saving and net capital outflow.

C) national saving.

D) net exports

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Because a government budget deficit represents

A) negative public saving,it increases national saving.

B) negative public saving,it decreases national saving.

C) positive public saving,it increases national saving.

D) positive public saving,it decreases national saving.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 404

Related Exams