A) tax evasion

B) a political payoff

C) a tax loophole

D) compensation for the benefit of society

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The deadweight loss of an income tax is determined by the

A) amount of total tax revenue to the government.

B) marginal tax rate.

C) average tax rate.

D) ability-to-pay principle.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If your income is $40,000 and your income tax liability is $5,000,your

A) marginal tax rate is 8 percent.

B) average tax rate is 8 percent.

C) marginal tax rate is 12.5 percent.

D) average tax rate is 12.5 percent.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) A general sales tax on food is regressive when low-income taxpayers spend a larger proportion of their income on food than high-income taxpayers.

B) A general sales tax on food is regressive when middle income taxpayers spend a smaller proportion of their income on food than high-income taxpayers.

C) A general sales tax on food is regressive when high-income taxpayers spend a larger proportion of their income on food than middle income taxpayers.

D) A general sales tax on food is regressive when high-income taxpayers spend a larger proportion of their income on food than low-income taxpayers.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Individual Retirement Accounts and 401(k) plans make the current U.S.tax system

A) less like European tax systems than it otherwise would be.

B) more like a payroll tax than it otherwise would be.

C) more like an income tax than it otherwise would be.

D) more like a consumption tax than it otherwise would be.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Medicare has been the focus of many proposed reforms over the last several years because

A) health care costs have risen more rapidly than the cost of other goods and services produced in the economy.

B) nationalized health care systems are more efficient than private health care systems.

C) cures for many major diseases are likely to be found in the next few years.

D) government health care research has found that limiting access to doctors will increase the general health of the population.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

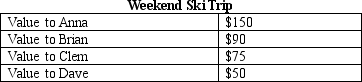

Table 12-3

-Refer to Table 12-3.Assume that the price of a weekend ski pass is $45 and that the price reflects the actual unit cost of providing a weekend of skiing.Suppose the government imposes a tax of $12 on skiing,which raises the price of a weekend ski pass to $57.How much tax revenue is collected from these four skiers?

-Refer to Table 12-3.Assume that the price of a weekend ski pass is $45 and that the price reflects the actual unit cost of providing a weekend of skiing.Suppose the government imposes a tax of $12 on skiing,which raises the price of a weekend ski pass to $57.How much tax revenue is collected from these four skiers?

A) $0.

B) $12.

C) $36.

D) $48.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If all taxpayers pay the same percentage of income in taxes,the tax system is progressive.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economists define a business's "value added" as

A) the amount the firm pays for goods and services less the revenue from the sale of goods and services.

B) the revenue from the sale of goods and services less the amount the firm pays for goods and services.

C) the total value of the goods and services created by the firm.

D) the value that consumers place on the goods and services created by the firm.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-3

-Refer to Table 12-3.Assume that the price of a weekend ski pass is $45 and that the price reflects the actual unit cost of providing a weekend of skiing.How much consumer surplus accrues to Anna and Clem individually?

-Refer to Table 12-3.Assume that the price of a weekend ski pass is $45 and that the price reflects the actual unit cost of providing a weekend of skiing.How much consumer surplus accrues to Anna and Clem individually?

A) $125 and $20 respectively

B) $105 and $30 respectively

C) $85 and $40 respectively

D) $65 and $50 respectively

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The federal budget deficit in 2009 was nearly eight times larger than the deficit in 2007.The primary reason for the dramatic increase in the deficit was

A) the recession experienced during this time.

B) severe budget tightening by members of Congress.

C) the shift in political power from Republicans to Democrats.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Of all the taxes collected in the U.S.economy,what percentage is collected by the federal government?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One advantage of a lump-sum tax over other taxes is that it

A) is both equitable and efficient.

B) doesn't cause deadweight loss.

C) would place a larger tax burden on the rich.

D) would raise more revenues.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

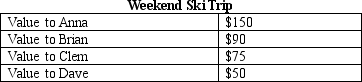

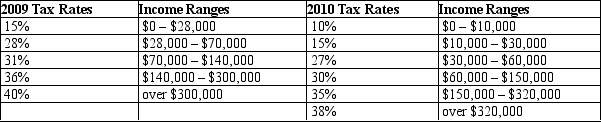

Table 12-12

United States Income Tax Rates for a Single Individual,2009 and 2010.

-Refer to Table 12-12.What type of tax structure does the United States have in 2010 for single individuals?

-Refer to Table 12-12.What type of tax structure does the United States have in 2010 for single individuals?

A) A proportional tax structure

B) A regressive tax structure

C) A progressive tax structure

D) A lump-sum tax structure

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the wages that a firm pays its workers is called

A) an income tax.

B) an excise tax.

C) a consumption tax.

D) a payroll tax.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Medicare is the

A) government's health plan for the elderly.

B) government's health plan for the poor.

C) another name for Social Security.

D) Both a and c are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

An efficient tax system is one that imposes small deadweight losses and small administrative burdens.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true about government spending on national defense?

A) It is the second-largest spending category for the U.S.federal government.

B) It includes salaries of military personnel.

C) It fluctuates over time as the political climate changes.

D) It is not financed with tax revenue.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Some colleges charge all students the same "activity fee." Suppose that students differ by how many campus activities they engage in.This charge is most like

A) an excise tax which conforms to the benefits principle.

B) an excise tax which violates the benefits principle.

C) a lump-sum tax which conforms to the benefits principle.

D) a lump-sum tax which violates the benefits principle.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following contributes to the projected rise in government spending on Social Security and Medicare as a percentage of GDP?

A) increasing life expectancies

B) increasing health care costs

C) increasing fertility rates

D) Both a and b are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 421 - 440 of 499

Related Exams