B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Peggy is an executive for the Tan Furniture Manufacturing Company.Peggy purchased furniture from the company for $9,500,the price Tan ordinarily would charge a wholesaler for the same items.The retail price of the furniture was $12,500,and Tan's cost was $9,000.The company also paid for Peggy's parking space in a garage near the office.The parking fee was $600 for the year.All employees are allowed to buy furniture at a discounted price comparable to that charged to Peggy.However,the company does not pay other employees' parking fees.Peggy's gross income from the above is:

A) $0.

B) $600.

C) $3,500.

D) $4,100.

E) None of the above.

G) A) and C)

Correct Answer

verified

A

Correct Answer

verified

True/False

Amy lives and works in St.Louis.In the morning she flies to Boston,has a three-hour business meeting,and returns to St.Louis that evening.For tax purposes,Amy was away from home.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Bob lives and works in Newark,NJ.He travels to London for a three-day business meeting,after which he spends three days touring Scotland.All of his air fare is deductible.

B) False

Correct Answer

verified

Correct Answer

verified

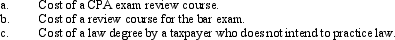

Essay

In terms of IRS attitude,what do the following expenses have in common?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The exclusion for health insurance premiums paid by the employer applies to:

A) Only current employees and their spouses.

B) Only current employees and their spouses and dependents.

C) Only current employees and their disabled spouses.

D) Present employees,retired former employees,and their spouses and dependents.

E) None of the above.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Nicole's employer pays her $150 per month towards the cost of parking near a railway station where Nicole catches the train to work.The employer also pays the cost of the rail pass,$75 per month.Nicole can exclude both of these payments from her gross income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not relevant in determining whether an activity is profit-seeking or a hobby?

A) Whether the activity is enjoyed by the taxpayer.

B) The expertise of the taxpayers or their advisers.

C) The time and effort expended.

D) The relationship of profits earned and losses incurred.

E) All of the above are relevant factors.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer who lives and works in Kansas City is sent to Chicago on an eight-day business trip.While in Chicago,taxpayer uses the hotel valet service to have some laundry done.The valet charge is a nondeductible personal travel expense.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

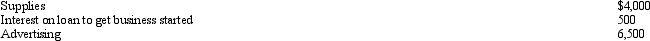

Rocky has a full-time job as an electrical engineer for the city utility.In his spare time,Rocky repairs TV sets in the basement of his personal residence.Most of his business comes from friends and referrals from former customers,although occasionally he runs an ad in the local suburbia newspaper.Typically,the sets are dropped off at Rocky's house and later picked up by the owner when notified that the repairs have been made.

The floor space of Rocky's residence is 2,500 square feet,and he estimates that 20% of this is devoted exclusively to the repair business.Gross income from the business is $13,000,while expenses (other than home office)are $5,000.Expenses relating to the residence are as follows:

What is Rocky's net income from the repair business?

What is Rocky's net income from the repair business?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ceiling amounts and percentages for 2013 for the two portions of the self-employment tax are: Social Security portion Medicare portion

A) $110,100; 12.4% Unlimited; 2.9%

B) $110,100; 15.3% Unlimited; 2.9%

C) $113,700; 12.4% Unlimited; 2.9%

D) $113,700; 2.9% Unlimited; 13.3%

E) None of the above.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Carla is a deputy sheriff.Her employer requires that she live in the county where she is employed.Housing is very expensive; so the county agreed to pay her $4,800 per year to cover the higher cost of housing.Carla must include the housing supplement in her gross income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Priscella pursued a hobby of making bedspreads in her spare time.Her AGI before considering the hobby is $40,000.During the year she sold the bedspreads for $10,000.She incurred expenses as follows:  Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

A) Include $10,000 in income and deduct $11,000 for AGI.

B) Ignore both income and expenses since hobby losses are disallowed.

C) Include $10,000 in income,deduct nothing for AGI,and claim $11,000 of the expenses as itemized deductions.

D) Include $10,000 in income and deduct interest of $500 for AGI.

E) None of the above.

G) B) and C)

Correct Answer

verified

E

Correct Answer

verified

True/False

A taxpayer who uses the automatic mileage method to compute auto expenses can also deduct the business portion of tolls and parking.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Joyce,age 40,and Sam,age 42,who have been married for seven years,are both active participants in qualified retirement plans.Their total AGI for 2013 is $120,000.Each is employed and earns a salary of $65,000.What are their combined deductible contributions to traditional IRAs?

A) $0.

B) $3,000.

C) $4,000.

D) $8,000.

E) None of the above.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

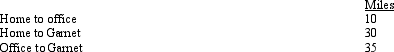

Multiple Choice

Amy works as an auditor for a large major CPA firm.During the months of September through November of each year,she is permanently assigned to the team auditing Garnet Corporation.As a result,every day she drives from her home to Garnet and returns home after work.Mileage is as follows:  For these three months,Amy's deductible mileage for each workday is:

For these three months,Amy's deductible mileage for each workday is:

A) 0.

B) 30.

C) 35.

D) 60.

E) None of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a married taxpayer is an active participant in another qualified retirement plan,the traditional IRA deduction phaseout begins at $95,000 of AGI for a joint return in 2013.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dave is the regional manager for a national chain of auto-parts stores and is based in Salt Lake City.When the company opens new stores in Boise,Dave is given the task of supervising their initial operation.For three months,he works weekdays in Boise and returns home on weekends.He spends $350 returning to Salt Lake City but would have spent $410 had he stayed in Boise for the weekend.As to the weekend trips,how much,if any,qualifies as a deduction?

A) $0,since the trips are personal and not work related.

B) $0,since Dave's tax home has changed from Salt Lake City to Boise.

C) $60.

D) $350.

E) $410.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Eileen lives and works in Mobile.She travels to Rome for an eight-day business meeting,after which she spends two days touring Italy.All of Eileen's airfare is deductible.

B) False

Correct Answer

verified

Correct Answer

verified

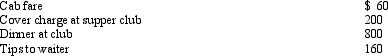

Multiple Choice

Robert entertains several of his key clients on January 1 of the current year.Expenses paid by Robert are as follows:  Presuming proper substantiation,Robert's deduction is:

Presuming proper substantiation,Robert's deduction is:

A) $610.

B) $640.

C) $740.

D) $1,220.

E) None of the above.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 168

Related Exams